Summary

During his presidential campaign, U.S. President-elect Donald Trump promised to deal with China, and he will be compelled to try and deliver success to his supporters. This will bring the United States and China into disagreement, so it is important to better understand the relative vulnerabilities in the trading relationship between the two countries. Therefore, Geopolitical Futures is conducting a bottom-up review of the economic relationship between China and the U.S. This preliminary study concludes that China is more economically dependent on the U.S. than the U.S. is on China. This is because the U.S. is not wholly reliant on China for any strategically important commodities or products, the U.S. has significant extra capacity in many of its manufacturing sectors, and the U.S. is resilient to Chinese retaliatory moves.

- China depends on U.S. imports of its products, and the U.S. also depends on imports of cheap Chinese products; however, China’s dependency is more severe.

- China appears to have a monopoly on certain commodities, such as rare earth elements, but the U.S. could find other sources for these commodities if necessary.

- The U.S. has significant extra manufacturing capacity in a number of key industries, and other countries are ready and willing to pick up the slack if China stops exporting cheap goods to the U.S.

- China would feel the impact of U.S. protectionist measures more than the U.S. would feel any economic retaliation China has at its disposal.

- A trade war between China and the U.S. would have negative consequences in the short-term for both countries, but these consequences would be more readily overcome by the U.S. than by China.

Introduction

When President-elect Donald Trump tweeted last Friday that he had spoken to Taiwan’s president, something no U.S. president or president-elect has done in decades, he made it clear to Beijing that he intends to change the nature of the relationship between the U.S. and China; it is also clear that he considers China to be the weaker and more vulnerable partner in the bilateral relationship. This, however, raises the obvious question of who actually has the upper hand in the economic relationship between the U.S. and China. It also calls into question what a renegotiation of the overall trading relationship between the two countries would look like.

The answer is complex and cannot be contained in a single piece. This piece will therefore be the first in a series of Geopolitical Futures explorations into the U.S.-China economic relationship, and it will serve as the framework for our future investigations. By looking at both the broader economic relationship and some specific case studies, this piece will dispel some of the myths about the power of China’s economy and will explain why China is far more dependent on the U.S. than the U.S. is on China. This piece will also explore the factors that are driving a redefinition of the trade relationship.

Access to Consumer Markets vs. Access to Cheap Goods

To evaluate the relative economic vulnerabilities of the U.S. and China to one another, it is necessary to begin by examining the fundamentals of their trading relationship. With the exception of 2013, the U.S. has been the top destination for Chinese exports for over 15 years (and in 2013 the U.S. was a close second to Hong Kong). In that period, the size of the Chinese economy, measured in terms of GDP, has increased by a factor of 10, from $1.3 trillion in 2001 to $10.9 trillion in 2015. China has accomplished this feat by leveraging the massive size of its potential work force to produce manufactured goods more cheaply than they could be produced elsewhere. China’s exports to GDP ratio peaked in 2006 at over 35 percent. Though that figure decreased to 22.3 percent last year, the decrease reflects reduced demand for Chinese products more than anything else. Last year, 18 percent of China’s exports went to the United States, a percentage three times bigger than the percentage of exports received by China’s second-largest importer by country, Japan.

China reached the limits of its export-led growth in 2008, after demand for Chinese goods fell during the financial crisis. China has been hiding this by pumping stimulus money into its own economy, leading to various irrationalities such as overcapacity of 30 percent or more in sectors including iron and steel, cement, aluminum, solar panels and power generation. China is now desperately trying to find a way to offload the overcapacity, which includes policy measures such as the overly ambitious “One Belt, One Road” strategy to cut prices on exports and make at least some return on the products themselves. The pressure to offload is beginning to appear in the banking sector, among others. Non-performing loans (NPLs) have steadily increased in China since 2012, though China claims its NPL percentage is just 2.15. Chinese statistics are notoriously unreliable, however, and it is possible to find estimates of China’s NPLs within a range of 3-20 percent. China is trying now to restructure its economy at an unprecedented pace and is therefore highly dependent on ensuring the top customer for its exports, the U.S., remains a stable trading partner.

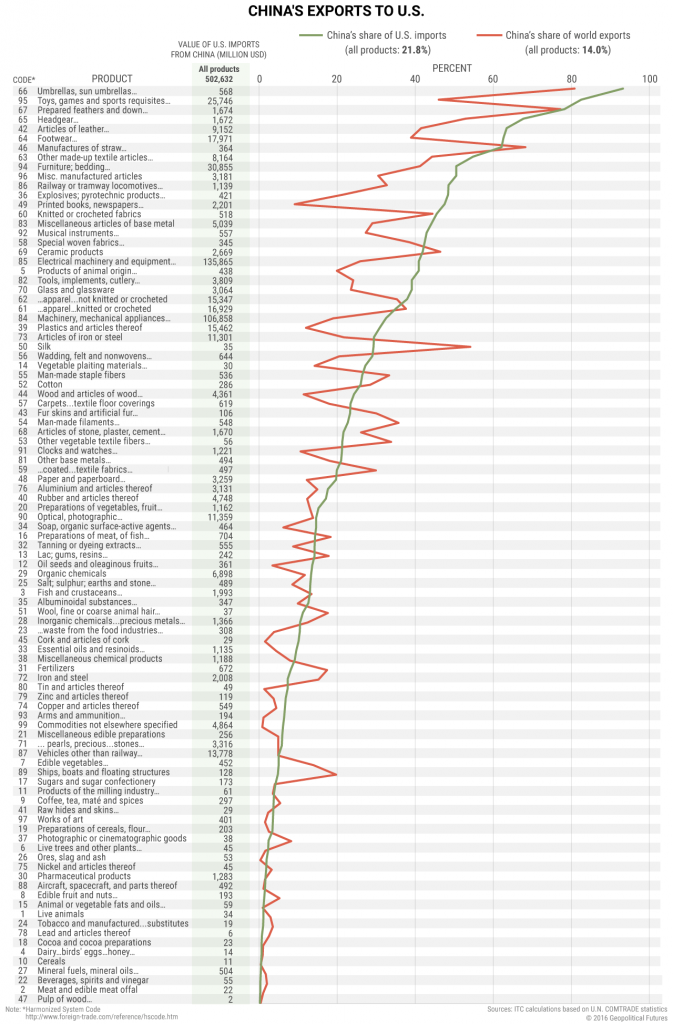

The U.S. also is exposed to China. The U.S. pushed for China to join the World Trade Organization (WTO) in 2001, which is when U.S. imports of Chinese goods took off in earnest. The U.S. saw both positive and negative results from its increased Chinese imports. The positive is that U.S. consumers gained access to cheaper goods because it cost less to make them in China than in the U.S.; major U.S. corporations also improved their bottom lines because it became easy to find cheap labor for the mass production of everything from umbrellas to iPhones in China. China became a convenient one-stop shop for building and selling products of all sorts, and an especially strong electronics supply chain emerged in Asia, centered around China. In 2015, 21.8 percent of U.S. imports came from China, and when broken down at the sector level, the U.S. dependency on China becomes even more conspicuous. Some of it is innocuous – that 93 percent of imported U.S. umbrellas and walking sticks come from China is interesting but unimportant. But the sheer number of products for which the U.S. depends on Chinese imports is striking, as shown in the chart below:

The negative impact of increased imports from China has been the loss of American jobs. From 1999-2011, U.S. workers lost at least 2.4 million jobs to China, according to researchers at the Massachusetts Institute of Technology and the University of California, San Diego. Those most affected by the U.S.-China trade relationship were not the ones celebrating each iteration of a new and affordable iPhone. Rather, they worked in U.S. manufacturing roles and tended to live in the Midwest or the Southeast. According to an in-depth report by The Wall Street Journal, those most affected by U.S. imports from China were white, less educated, older and poorer compared to the rest of the U.S. population.

Trade with China was not the only factor in creating this situation, but it played a major role in the development of a social crisis, one that Trump has ridden all the way to the Oval Office. Trump knows his voter base very well, and he knows why this segment of the population voted for him. Trump promised to punish China by increasing protectionist measures against its exports, and he needed to make a gesture, even before taking office, to show that he will follow through to stop China from what his supporters see as open-highway robbery of the American people, enabled by a class of free trade-preaching politicians.

3 Case Studies

The U.S. and China are dependent on each other in different ways, but the oft-repeated assertion that the economies are too interconnected for the U.S. to increase protectionism does not hold up to scrutiny because the dependencies are not equivalent. Trump will be compelled to do what he claims to do best: negotiate a better deal for American workers. As he does this, he will be able to deploy three main arguments in his negotiations with the Chinese. The first is that U.S. dependence on Chinese goods is a matter of convenience, not of China possessing critical commodities the U.S. can’t obtain anywhere else. The second argument is that although the manufacturing sector of the U.S. economy has been hurting for years and is significantly degraded, a great deal of unused U.S. capacity remains; in the event of a serious economic conflict with China, this unused capacity could be relied upon to pick up much of the slack. The third argument is that U.S. protectionist measures raised against Chinese goods will hurt China far more than any of China’s potential retaliatory responses will hurt the U.S. To illustrate these points, we will present three short case studies.

Rare Earth Elements (REEs)

One category of imports for which the U.S. appears to be especially dependent on China is rare earth elements (REEs). REEs are actually not rare, just difficult and costly to mine, and China has been willing to do this more cheaply than any other country. As a result, China has developed a de facto monopoly in the REE market. REEs are important because they are needed to produce a wide range of products, including flat-screen televisions and laptop hard drives as well as many military weapons systems. REEs became better known in 2010 when China responded to Japan’s detention of a Chinese fishing trawler captain by placing an embargo on REE exports to Japan. The U.S., Japan and various EU nations were already upset with China for reducing REE export quotas prior to the embargo, but that same year, China cut export quotas by 40 percent, sending the price of many REEs skyrocketing.

On the surface, REEs have all the telltale signs of a key import vulnerability. According to a 2013 Congressional Research Service report, the U.S. was once self-reliant in REE production; however, in the 15 years prior to the report, the U.S. developed a 100 percent reliance on REE imports, the vast majority from China. The U.S. Geological Survey (USGS), on the other hand, indicates that from 2011-2014, U.S. import reliance for REEs was only at 76 percent, with China averaging approximately 71 percent of that supply. It is not only the U.S.’ import reliance that makes REEs a good case study for relative trade vulnerability – the portion of the market China has cornered also does.

According to the latest figures available, China has produced 89 percent of the world’s total REEs in 2016. China currently has a monopoly over REEs, and it would be a powerful point of leverage to use in its relationship with the U.S. if China was able to enforce that monopoly. However, the U.S. is able to produce REEs if it absolutely needs to. Molycorp was one of the main companies involved in domestic REE production, and potential top production at its Mountain Pass mine in California was estimated at just over 19,000 metric tons in 2014, enough to satisfy almost all current U.S. REE consumption. The amount of REEs required by the Department of Defense is thought to be only 5 percent of total U.S. REE consumption, according to the Congressional Research Service, so U.S. domestic REE production can easily handle the load for the nation’s most important REE requirements. Molycorp has since ceased operations and declared bankruptcy because REE prices were too low to make U.S. production profitable for private enterprise. This happened when China removed its export quotas to prevent dilution of its market share if other countries tapped into their domestic REE reserves. According to the USGS, the REE market was also oversupplied because some Chinese companies produced REEs illegally, hoping to generate extra profits.

REEs are often thought of as one of China’s most powerful tools in trade negotiations because of China’s dominance in terms of international supply. The reality is that China’s dominance in the REE export business is much more powerful as a threat leading to temporary shortages and instability. If China were to stop exporting REEs to the U.S. because the U.S. slapped a tariff on Chinese imports, the result would be a few chaotic months in the U.S. as well as higher costs for some cellphones and other electronics with REE components. However, the result would not be a catastrophe and actually would spawn a capacity for REE production in the U.S. or another country, such as Australia, from which the U.S. could import. In the long term, reduced REE imports from China would be a minor inconvenience for the U.S. and would cripple an entire industry in China.

Further studies of key U.S. imports from China will be undertaken in future pieces, but our preliminary research suggests that there is no single commodity for which the U.S. depends on China that cannot be obtained elsewhere. REEs happen to be a particularly clear example, but they are not idiosyncratic – they are a representative case.

Furniture

The second trump card the U.S. can play in any trade negotiation with China is the great deal of unused capacity within the U.S. manufacturing system. This can clearly be seen in the case of furniture production in the U.S. We chose furniture as a category because although classification systems for U.S. domestic production and international trade often differ, furniture is a category where the classification systems line up well enough to make a rough comparison. Furniture production is also a good example of an industry in which Chinese imports to the U.S. hurt American workers. In 2008, personal consumption expenditures in the U.S. for furniture were $160.5 billion, according to the U.S. Department of Commerce. Total U.S. imports of furniture were $41.9 billion, of which a little more than half came from China. That means in 2008, 13.7 percent of furniture bought domestically was imported from China. In 2015, U.S. personal consumption expenditures of furniture increased to $181.1 billion, and Chinese exports of furniture to the U.S. increased by 41 percent, the result being that roughly 17 percent of furniture bought in the U.S. came from China.

This shows that when it comes to furniture, U.S. consumers are buying more imports –specifically, more imports from China. What these numbers don’t show, however, is the current relationship between the amount of furniture being produced domestically and the amount of furniture that could be produced domestically (the sector’s capacity utilization). This information is kept by the U.S. Federal Reserve, which shows that in the U.S., furniture producers have had significantly underutilized capacity in recent years. The 2008 average for capacity utilization was 78.4 percent, and in 2015 the monthly average has hovered around 76 percent. In practical terms, this means that if U.S. capacity utilization had been increased to 85 percent in 2015, U.S. domestic production of furniture could make up for more than half of all furniture imports from China. This is true not just in the furniture sector but across many U.S. industry groups.

Of course, increasing capacity would not be easy. One caveat is that many of these industry groups have seen their capabilities atrophy after years of dismal performances in the face of cheap imports from China and other low-wage countries that produce cheaper goods. But these industries are much like muscles, atrophying in bad times but strengthening in good times. This is one of the key structural differences between the U.S. economy and the Chinese economy –U.S. companies shut down when they are not profitable, whereas China pumps money into the system to preserve social stability at all costs, a large part of the reason the Chinese economy is currently struggling. Still, the loss of Chinese furniture and other imports would be disastrous for many U.S. consumers in the short to medium term. If China simply stopped exporting furniture and other commodities and goods to the U.S., there would be a painful adjustment period as consumers faced much higher costs for basic goods. But this is a study of relative vulnerability, and the key point here is that it would be painful if China cut off imports to the U.S., but it would not cripple the U.S. and could even spur domestic production in the long term. In China, losing U.S. consumers would result in industries failing. The Chinese government would then either have to keep them afloat or let them collapse. As the latter is not an option for China, the inherent problems of keeping industries afloat would place even further stress on a system reeling from decreased demand.

Tires vs. Chickens

The third key U.S. advantage in a potential trade spat with China is something we’ve been dancing around in this report but which we will now address directly: The U.S. is more resilient to tit-for-tat economic retaliation than China is. U.S. President Barack Obama is generally speaking as an internationalist, but he did break from some previous U.S. policies when it came to China. In September 2009, for example, in response to a petition by a union representing American tire workers, Obama slapped a 35 percent tariff on automobile and light-truck tires imported from China. Then, in July 2015, the U.S. International Trade Commission extended those duties on Chinese imports for a minimum of five years. China responded to Obama’s move in 2009 a few days later by imposing its own tariffs on U.S. exports of chicken meat to China. However, the U.S. tariff has wounded China far more than the Chinese tariff has wounded the U.S.

The U.S. tariff has had a limited but measurable positive effect for domestic tire producers in the U.S. According to the Rubber Manufacturers Association, the U.S. tire industry slightly increased its market share at the expense of foreign imports in 2015. Furthermore, passenger tire imports from China fell by over 50 percent during that same year. The flip side, however, is that the decrease in imported Chinese tires was not picked up by domestic U.S. production. Rather, it was picked up by other export-happy Asian countries like South Korea, Thailand, Indonesia and Taiwan, all of which saw their exports of tires to the U.S. double in value.

This is where there are severe limitations on what Trump can accomplish in trade policy. Trump could try to incentivize companies to return to the U.S. by imposing tariffs like the ones currently in place on tires, but there is a fleet of other countries eager to follow in China’s footsteps as high-growth, low-wage economies. Trump may be able to impose some tariffs on China without congressional approval because of a WTO provision authorizing the president to raise tariffs upon receiving a substantiated complaint from a company or group that can prove it was negatively affected by a market disruption or a surge in imports from another country. While it may be possible for companies and industries to substantiate claims about China, it will be far more difficult to do so regarding other countries. Therefore, Trump’s legal ability to impose such measures on other countries seeking to replace Chinese production is ambiguous at best. Geopolitical Futures has conducted a detailed study of these countries and has concluded that U.S. companies will have plenty of options should China become an untenable base of operations.

Partly (but not entirely) due to U.S. tariffs, China’s tire industry is in shambles. According to Tire Industry Research, China’s capacity utilization in the various tire segments industry has fallen to between 50 and 60 percent. Hundreds of tire factories have closed their doors, and Chinese tire makers are cutting prices to the bone just to stay competitive in the market. At the same time, the U.S. poultry industry has experienced no long-term ramifications due to the Chinese tariff. Various groups are lobbying the U.S. government to put pressure on China to remove the poultry tariffs, but chicken exports bounced back in 2011 and then almost doubled in value until an outbreak of avian flu put a damper on foreign sales in 2016. Overall, the value of poultry production in the U.S. increased, meaning China’s retaliation for the tire tariffs was fairly ineffective. It is likely that future retaliatory measures would yield similar results: a short-term impact for the U.S. followed by a recovery.

A cyclist rides along a dusty road where dozens of factories processing rare earth elements operate on the outskirts of Baotou city in northwest China, on April 21, 2011. FREDERIC J. BROWN/AFP/Getty Images

What Cards Does China Have?

None of the analysis in this article is meant to imply that China has no leverage in its economic relationship with the U.S., nor does it suggest that a fully-fledged trade war between China and the U.S. would have only a minor impact on both countries’ economies and the global economy. Working in China’s favor is the fact that numerous American companies also operate in China and derive a substantial portion of revenue from China operations. Boeing, for example, earned 13.1 percent of its annual revenue in 2015 from its Chinese operations and projects Chinese earnings to increase in the future. Starbucks received 5.7 percent of its revenue from China in 2015, and China represented roughly a quarter of Apple’s net sales in 2015. In the event of a trade war, there are a number of things China could do to make life difficult for American companies operating in China. For example, China could rally nationalistic sentiment against U.S. brand products, as it did to Japan in 2012. China cutting key imports into the U.S. would also raise prices for American consumers and, in the short term, create a great deal of uncertainty and economic hardship for typical American consumers. Additionally, American companies with operations in China would face large costs and time delays while finding new places to relocate production facilities.

Still, these potential problems pale in comparison to the cards the U.S. holds on this particular issue. U.S. imports of Chinese goods appear to be a convenience; without them, the U.S. would either endure and adapt or heavily reinvest in its own domestic capabilities. China, on the other hand, would not be able to make up its lost U.S. exports by exporting to another country. Furthermore, China is often regarded as a large potential consumer market, but the key word is “potential.” The latest data on household consumption expenditure shows that U.S. consumer expenditures were almost $12 trillion in 2014 – triple the size of China’s consumer expenditures, and over a quarter of the world’s total consumption. For example, McKinsey & Company projected that the size of China’s consumer market would exceed the U.S. consumer market by 2020; however, that projection assumed that China would continue to grow at preternatural rates, which has proven to be wishful thinking. The U.S. still holds its place as the global consumption machine and will continue to do so. It is often assumed that the Chinese economy drives the U.S. economy, when in fact it is the other way around.

Conclusion

China is more dependent on the U.S. than the U.S. is on China, and Trump has a political imperative to pursue a change in the U.S. trade relationship with China. His recent conversation with Taiwan’s president hints at how he will attempt to achieve that goal: He will emphasize U.S. strengths relative to Chinese weaknesses rather than trying to reach compromise agreements with Chinese President Xi Jinping, and thus the potential for a trade war exists. Skirmishes between China and the U.S. are already underway when it comes to protectionism and trade, to no great destabilizing effect, and a trade war would be a last resort for both countries even if the U.S. is more protected from the potential ramifications. Threatening to impose harsh tariffs or import cut-offs is more effective as a threat than anything else, and these tactics are the diplomatic maneuvers of an economic conflict. It is important to keep in mind that the U.S. is less vulnerable to Chinese actions; furthermore, China must have access to U.S. consumer markets, and Trump knows it. These realities will shape the U.S.-China economic relationship going forward.