By Jacob L. Shapiro

On Jan. 24, an official Philippine delegation wrapped up a visit to China. The previous day, both countries issued statements saying they reached an agreement that China would provide the Philippines with $3.7 billion to fund 30 projects. The Philippine finance secretary said in a statement that the projects would include infrastructure schemes, such as irrigation systems, power plants and railroads. This is a small part of a much larger development: China is attempting to buy an alliance with the Philippines. China gets a huge amount of attention for its saber-rattling in the South China Sea. But the possibility that China could secure an alliance with the Philippines is much more important because it would significantly improve China’s strategic position in the region.

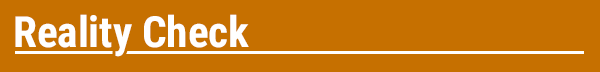

China is currently hemmed in by a group of islands, referred to as the first island chain, off its coast. In a serious military conflict between China and the United States, or even China and a regional power with a formidable navy such as Japan, these islands would become a distinct weakness. The map above clearly shows why China would want to build an alliance with the Philippines. A Chinese-Philippine alliance would remove a key partner in the U.S. alliance structure. It also would secure Chinese access beyond the first island chain and allow China to base military assets at an important strategic location in the Pacific.

This photo taken on Jan. 2, 2017 shows Chinese J-15 fighter jets being launched from the deck of the Liaoning aircraft carrier during military drills in the South China Sea. The aircraft carrier is one of the latest steps in China’s military buildup, as Beijing seeks greater global power to match its economic might and asserts itself more aggressively in its own backyard. STR/AFP/Getty Images

China faces two key challenges to successfully close the deal. First, China must entice the Philippines into an alliance – it cannot force Manila to bend to Beijing’s will. China’s navy is vastly superior to the Philippines’ navy, but as long as the Philippines’ mutual defense treaty with the U.S. is in place, China cannot conquer the Philippines or attempt to hold it for a meaningful period of time. That means China has two options: covertly work to destabilize the domestic situation in the Philippines, or attempt to use the promise of aid and development to buy Philippine allegiance. These are not mutually exclusive options.

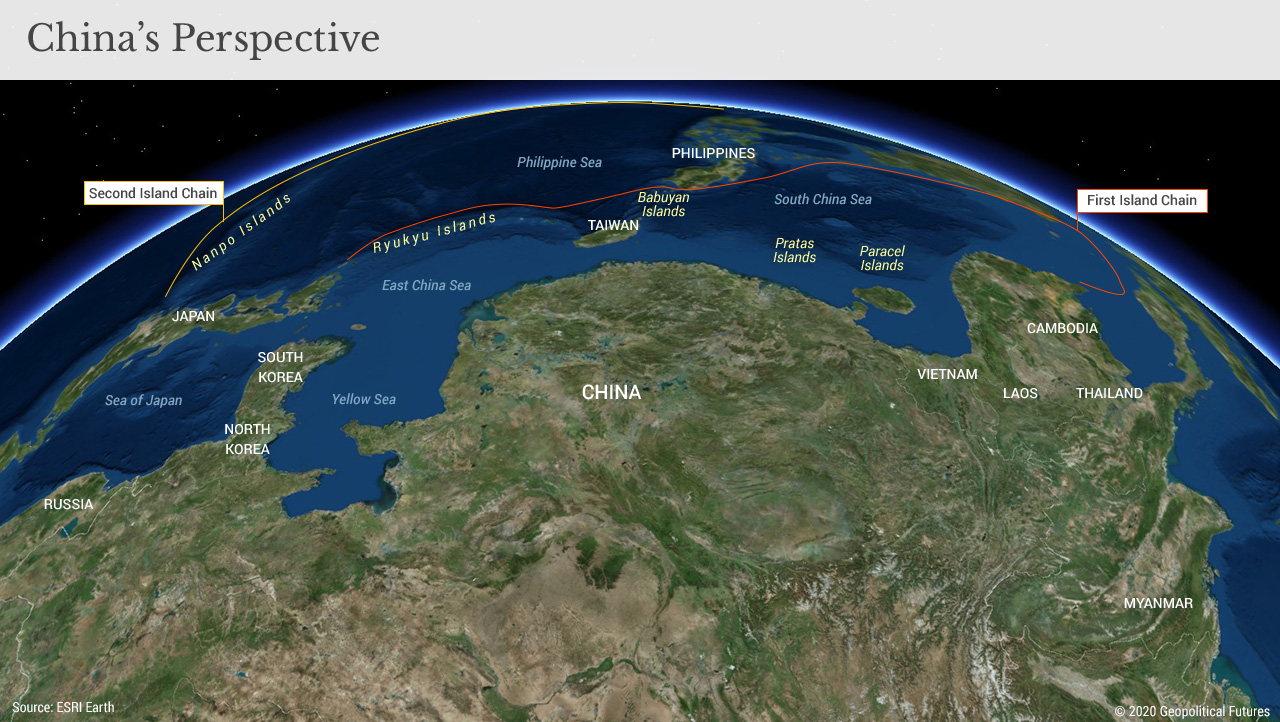

China does not need to work hard on the first option. The Philippines has a populist president, who is attempting major domestic changes and is open to a different relationship with China. The issue China faces in pursuing the latter option is twofold. First, China’s economic influence in the Philippines currently is relatively limited. China is one of the Philippines’ most important trading partners – but so are the U.S., Japan, South Korea and Taiwan, none of which would be pleased by a Chinese-Philippine alliance. China also is not currently a major investor in the Philippines. As the graph below shows, China’s investments in the Philippines over the last three years pale in comparison to those by Japan, the U.S. and Singapore – all countries that are diametrically opposed to a change in the balance of power in the Pacific.

China, however, is trying to change this. In October 2016, China and the Philippines reportedly signed deals worth $24 billion during Philippine President Rodrigo Duterte’s visit to China. This includes $15 billion in investment and $9 billion in credit facilities. This week’s announcement of $3.7 billion is the first chunk of that much larger investment to be doled out. Foreign investment in the Philippines totaled $4.9 billion in 2015 (data for all of 2016 is not yet available). Thus, just this first installment is equivalent to 75 percent of the Philippines’ foreign investment in 2015. China’s investment and credit offers are a significant tactical move to gain a source of leverage in the Philippines. The Center for China and Globalization reported that Chinese foreign direct investment in 2015 totaled $145 billion. Considering the Philippines’ strategic importance to China, and considering how much less expensive throwing money at Manila would be than building five carrier battle groups or developing sophisticated anti-submarine capabilities, China has both the ability and the will to use economic heft to try to secure a better relationship with the Philippines.

However, when it comes to the impact of investment on the relationship between two countries, the devil is always in the details, and so far, the details on these deals are lacking. China’s commerce minister declined to provide details about the initial batch of projects and noted that they still need to be finalized.

This leads to China’s second challenge in developing closer ties with the Philippines: Its friendship comes with strings attached, which may deter the Philippines. China’s endgame is to secure a relationship that would allow it to station military assets in the Philippines. This would be a major reversal of Philippine policy and would face strong opposition there, both from the broader population and institutions such as the military that are more wary of China than Duterte.

There is a deeper problem and a major conflicting imperative: China wants the Philippines to drop its claims in the Spratly Islands and recognize Chinese sovereignty in the South China Sea. China has already taken some of the Spratly Islands from the Philippines and can limit access for Philippine fishermen at will, and it has shown no hesitance in doing so when unhappy with Manila’s moves. Part of the Philippines’ frustration is it views the United States as not adequately defending Philippine territorial claims and therefore not living up to their treaty’s terms. If the U.S. had honored the treaty, from this perspective, the U.S. would have made sure China could not take Scarborough Shoal or any other island and “maritime feature” on which China is building runways and stationing missile batteries.

The potential economic volatility that would result from putting all its eggs in Beijing’s basket and China’s desire to assert sovereignty over territory the Philippines considers its own are the major stumbling blocks to a Chinese-Philippine alliance. This is true regardless of what Duterte says or how much China invests in the Philippines. It is premature to view China’s investment deals in the Philippines as consequential because the Philippines has been vocal in protesting Chinese moves in the South China Sea in recent weeks, filing a diplomatic protest, hosting Japan’s prime minister and having key government officials critique Chinese actions in the region. If China goes ahead with the investment, the Philippines will be able to have its cake and eat it too: It will get money from China and won’t have to give up its claims. However, if China demands changes in Philippine behavior or territorial claims, or becomes too heavy-handed in what it is offering currently, it could push the Philippines away. In the meantime, at least Manila will have attracted some more attention from regional powers and the U.S. during its flirtation with China.

These are major challenges, and overcoming them will be difficult. The likelihood is that the Philippines will remain in the American sphere of influence, even if the Philippine president despises the U.S. on an ideological level. Even so, the challenges to securing a strategically significant relationship with the Philippines are more manageable for China than attempting to fight the U.S. Navy or attempting an amphibious invasion of Taiwan. China is making a move in the South China Sea, and it has nothing to do with Fiery Cross Reef or its rudimentary aircraft carrier crossing the Taiwan Strait. Watching whether these investments come to fruition and whether China can increase its influence over the Philippines will be important in benchmarking China’s strategic position in the next few years.

The Geopolitics of the American President

The Geopolitics of the American President