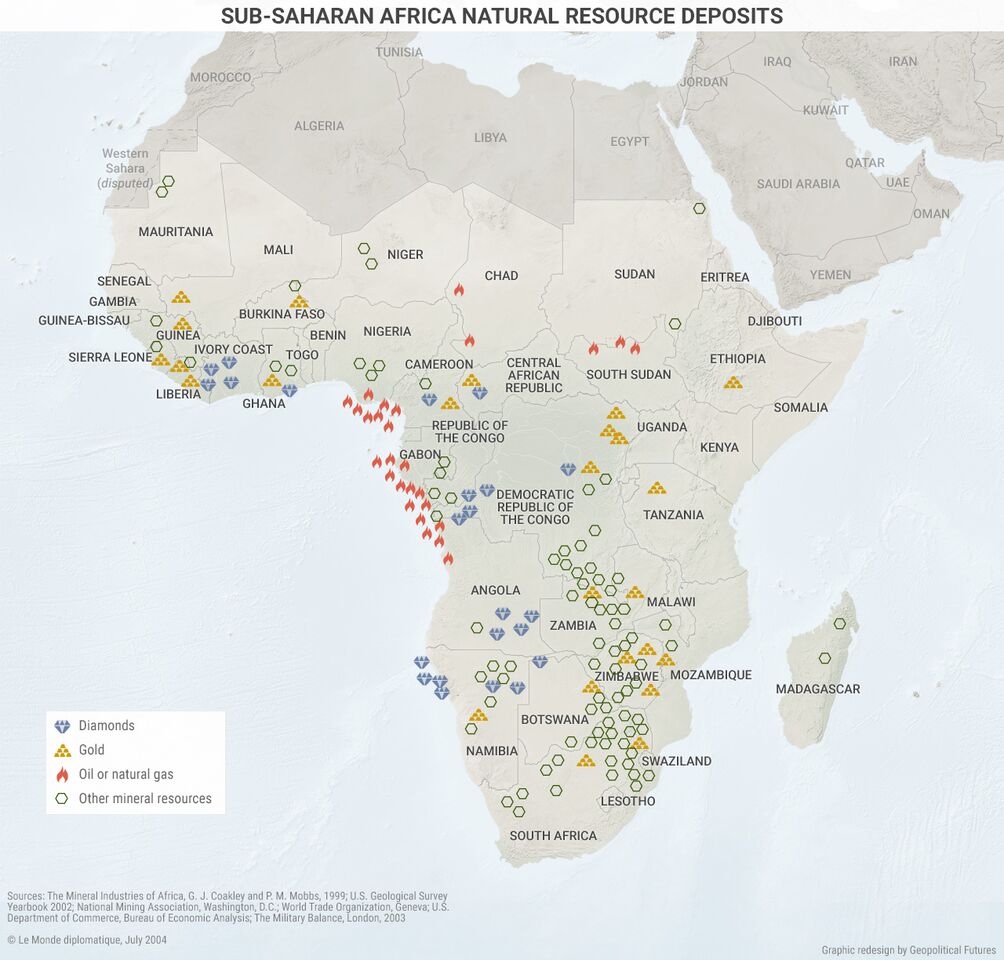

China’s slowing economy intensified the crisis for countries like Zambia, the DRC and Angola. Zambia’s trade relationship with China, its second largest partner, is based almost exclusively on copper – which is significant considering that all exports (almost two-thirds of which are copper by value) account for 39 percent of Zambia’s GDP. In the case of Angola and the DRC, China is their leading trade partner, accounting for nearly 50 percent of exports for each country.

However, one can find a bright spot in East African countries, particularly Ethiopia, Kenya, Uganda and Tanzania. The absence of large raw material deposits in these countries (compared to others in the region) forced the local economies to grow and generate revenue through other means. These countries also show relatively high growth rates and have large, low-wage working populations. The combination of these two factors make these countries attractive and promising locations for developing a basic manufacturing industry. To read more on the outlook for Sub-Saharan Africa and other regions, see our forecast for 2016.

Special Collection – The Middle East

Special Collection – The Middle East