The current breakdown of the global supply chain threatens to change the future of the world. If this worsens, the fabric of the global economy will be torn – though I don’t know exactly how many months it would take – and reconstructing it will take longer than breaking it did.

Similar disruptions have been seen in wars when production facilities were destroyed and maritime trade was disrupted or suspended. In World War II, imposing economic disruption on the enemy while preventing the enemy from doing the same to you was if not the essence of the war then certainly critical. We are not seeing anywhere near those levels of disruption now, but the mechanics of what we are seeing have more in common with war than with ordinary economic events. Right now, it appears to be a major inconvenience. Over time, it could be much more.

In mid-2020, I wrote a piece about the course of the COVID-19 crisis. I argued (not very originally) that there were two courses the economic fallout of the pandemic could take: recession or depression. The possibility of robust growth was not in my mind an option. I defined recession as a financial event, painful but ultimately recoverable without substantial, long-term damage. I defined depression as the physical destruction of the economy, with companies and banks failing and ceasing to exist, massive unemployment, and so on. Depression might have a financial component, as the Great Depression in the United States did, or a military component, as it had in much of Europe after both world wars. A recession may take years to recover from. A depression takes a generation. I also said that in my mind, the pandemic would not cause a depression. My thinking was that in due course the pandemic would either subside on its own or give way to a medical solution. The key factor was how long the measures used to combat the disease would be in place. The longer the time, the greater chance of depression.

We are now seeing the physical degradation of the global economic system with shortages and disruptions that are not soluble by financial measures. We are seeing a phenomenon that appears to consist of many systems failing and interacting at the same time. Everyone has a different theory for the failures, but there is one that virtually everyone selects as a central cause, even if they disagree about its origins.

In the United States, there is a two-part thesis. The first is that overly generous unemployment and stimulus benefits reduce the willingness of many to work. People can make more money by staying at home. The problem with this claim is that someone who forgoes a salary for benefits wasn’t earning much to begin with. They would be relatively low-paid workers with little if any savings. It is hard to imagine they could not be coaxed back into the workforce. And it assumes the warehouse or restaurant the employee used to work at could outbid the benefit but either didn’t or wouldn’t. Certainly, I haven’t seen the balance sheets of these companies, but having relatively low-paying jobs left unfilled shouldn’t paralyze a business. In addition, in many sectors, job vacancies are at levels far above the point where they would be influenced by federal benefits. Benefits did not create massive labor shortages in the area of skilled labor, professional work, management and so on. Yet there are shortages there as well.

The second part of the thesis is the withdrawal of women from the workforce for home care. This is more persuasive than the first part of the theory but still flawed. U.S. labor statistics say some 1.8 million women remain out of work, but that doesn’t necessarily give us the full picture. Most of the schools that were initially closed have since been reopened. Some women have had babies during the pandemic and have thus recused themselves from the workforce, but others haven’t. About 40 percent of U.S. homes have children under the age of 18, and about 20 percent have children under the age of nine. Every household, I’m sure, has different standards for how young is too young for a child to be left alone, and different tolerances for how much money is acceptable to forego for child care. We must always remember that many of us work because we have to. The number of women who either do not need their paycheck or have no way to care for a school-age child seems insufficient to explain the magnitude of the loss in the labor force.

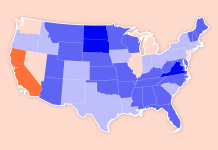

Importantly, many of these theories use the American model as the essential one, but what may explain shortages in the U.S. may not hold true for another country and vice versa. Some of these countries have vastly different cultures, job markets and so on. In China and Israel, for example, the shortage is in workers with technical expertise. Anecdotally, I know that in Italy, where it’s common for extended family members to live together, mothers may work while grandmothers care for the children.

What I think is clear is that we do not know why there has been a global reduction of labor, unless it took place only among those who don’t need to work (and those people have Zoom). That is not a good answer, but it has some value. This is what is most frightening about this development. Many agree that a labor shortage is a key driver of the supply chain problem. Yet the dominant theories of what happened, while not refuted, have many weaknesses. That means that there must at least be additional explanations. So, we are facing a depression, originating not in financial events but in the displacement of people, transport and other elements. Facing a system failure with a known cause is one thing. Facing one for which you have no model is another.