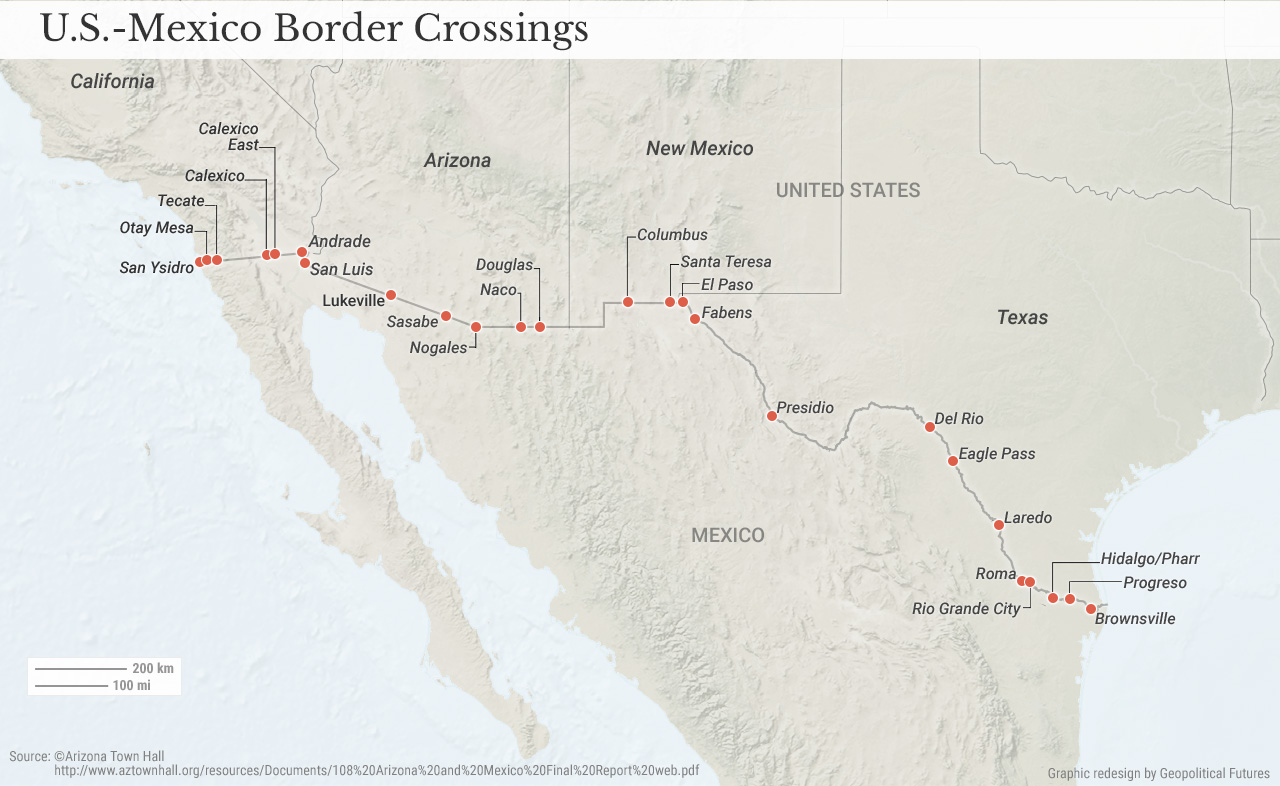

Mexico figures as a prominent destination for U.S. exports and ranks among the top three export destinations for 33 of the 50 U.S. states. However, Mexico ranks as the top export destination for only four states. It is no coincidence that these four states are along the U.S.-Mexico border. The geographic proximity of California, Arizona, New Mexico and Texas to the Mexican border heavily impacts these states’ economies and demographics, and politicians’ stances as they relate to national politics.

These four state economies depend on trade with Mexico and account for a quarter of U.S. GDP. To read more about how California, Arizona, New Mexico and Texas will pose the greatest challenges to the administration of President Donald Trump and its initiatives for increasing tariffs on Mexican goods, read Geopolitical Futures’ latest Deep Dive, “Exploring the US-Mexico Trade Relation Part 2.”

Special Collection – The Middle East

Special Collection – The Middle East