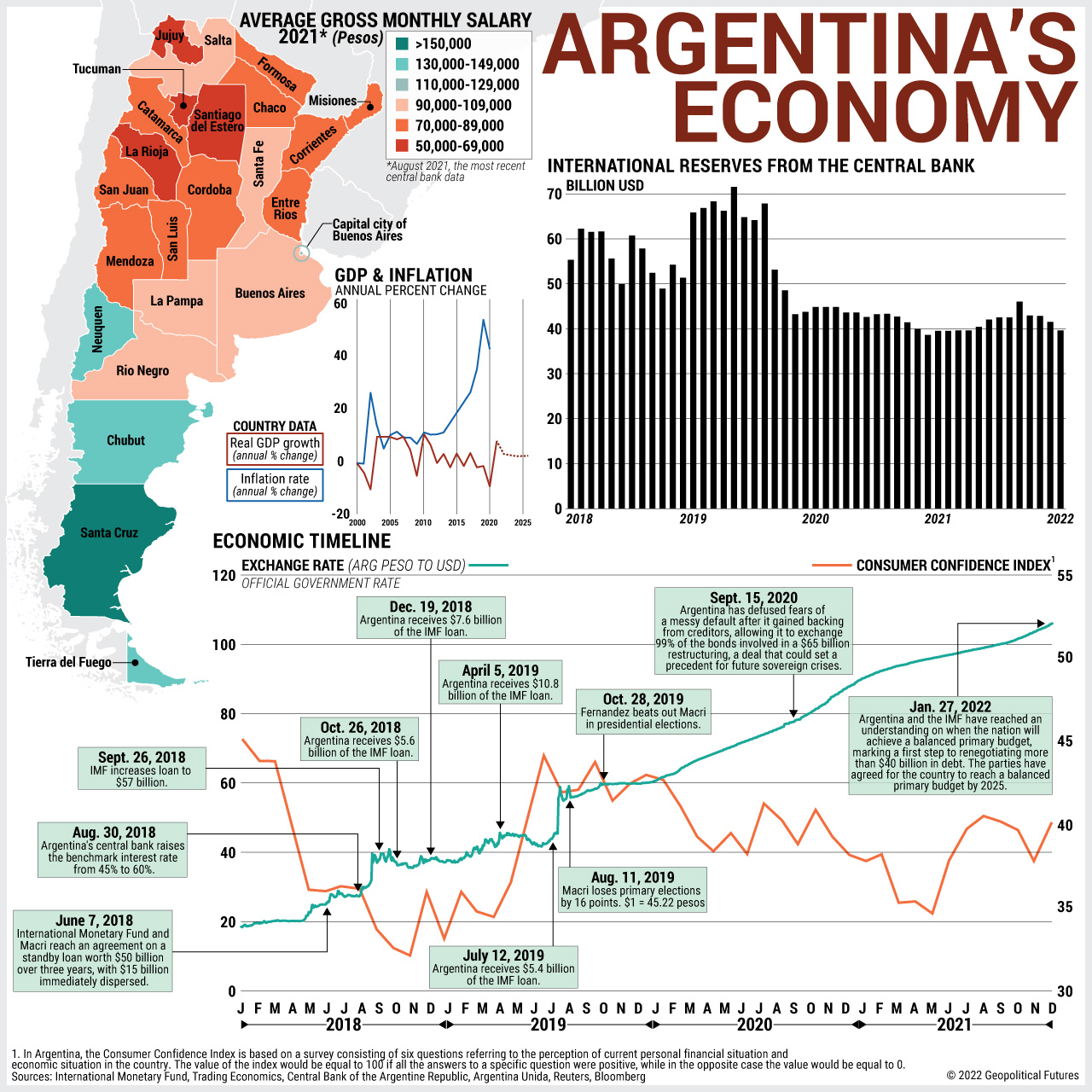

Argentina is no stranger to economic crises and conflict with the International Monetary Fund. For years the country has navigated a minefield of challenges related to inflation, currency controls, subsidies and trade protection measures. Its steady agriculture exports have played a key role in maintaining international reserves and, in turn, helping to stabilize the currency. Nevertheless, the government remains mindful of vulnerabilities like drought and farmer strikes that could jeopardize the inflow of U.S. dollars. Inflation and a falling exchange rate have consistently reduced purchasing power over the past decade. The peso is weaker than the official exchange rate, with the parallel market value closer to 200 pesos to the dollar.

The weak economy has incentivized the Argentine government to push back against the IMF and call for a renegotiation of payment terms for some $44 billion of outstanding debt. The IMF has not accepted Argentina’s demands but has shown greater flexibility than in the past due to the increased complications brought on by the pandemic. While the latest round of talks with the IMF resulted in some fractures within the Argentine governing coalition, members of the opposition support President Alberto Fernandez’s stance, which will help keep things on track with the IMF.

Special Collection – The Middle East

Special Collection – The Middle East