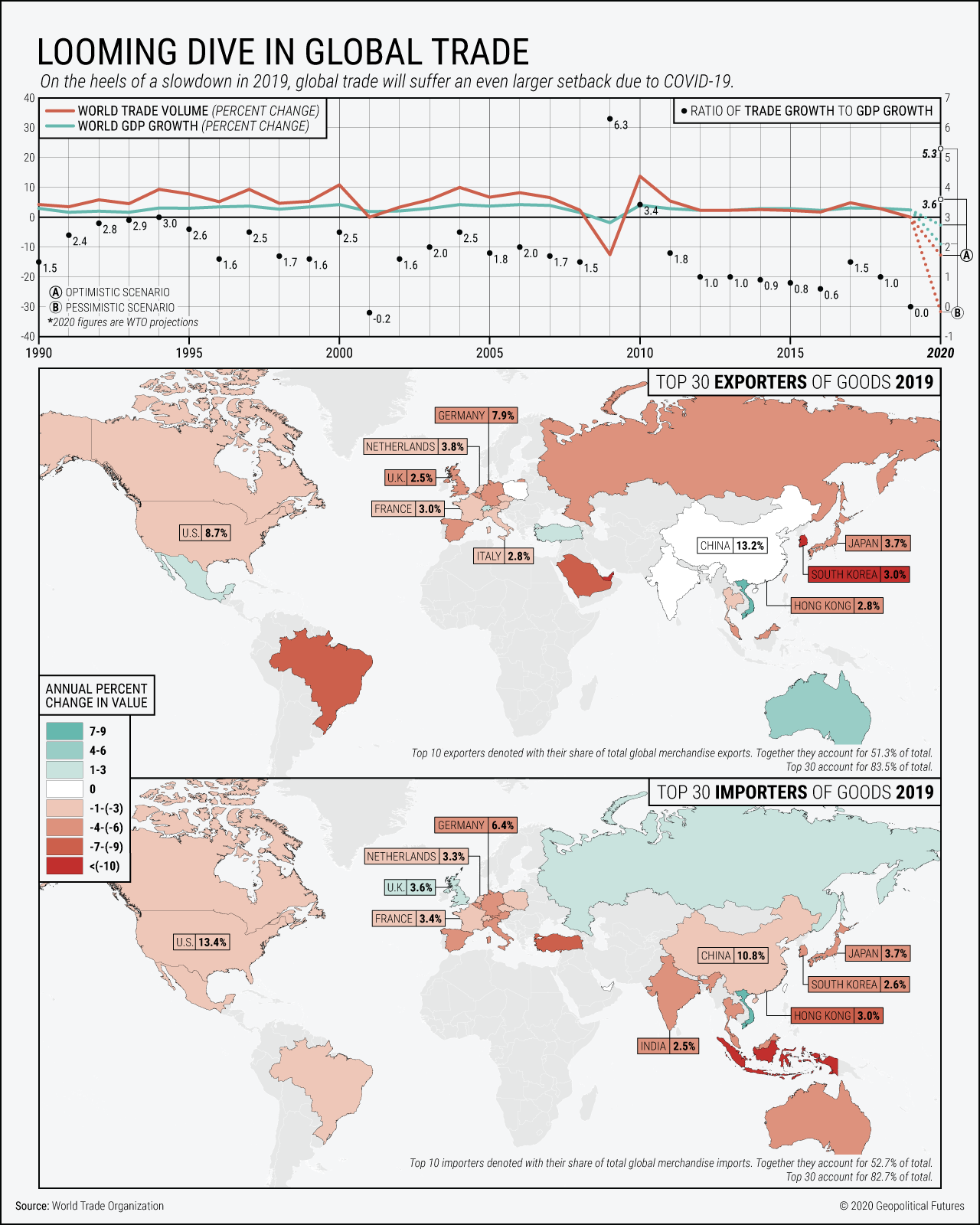

The World Trade Organization revised its forecast for global trade this year to reflect the impact of the coronavirus pandemic — and the outlook is bleak. Just how bad things get will depend on how long social distancing measures are in place. Countries that depend on exports, such as China and Germany, will be especially vulnerable to the crash in global trade.

The trade problems first kicked off with the Wuhan lockdown and travel restrictions within China, which ground factories to a halt and disrupted global supply chains. Since then, the problems have grown. Many countries have suspended nonessential production. Others, such as South Korea, have kept economic activity running but suffered negative consequences due to the absence of buyers. There are breakdowns on the supply and demand sides of the trade equation. Looking at the scale of the economic downturn, nearly all countries will experience a strong downturn in trade.

In the WTO’s optimistic scenario, global merchandise trade will fall by 13 percent compared to last year. By volume, exports of merchandise will fall by 17.1 percent in North America, 13.5 percent in Asia and 12.2 percent in Europe. Imports will fall by 14.5 percent, 11.8 percent and 10.3 percent, respectively.

In the worst-case scenario, global merchandise trade will plummet by 32 percent relative to 2019. This includes a fall in merchandise exports from North America of 40.9 percent, from Asia of 36.2 percent and from Europe of 32.8 percent. Imports would drop by 33.8 percent to North America, 31.5 percent to Asia and 28.9 percent to Europe.