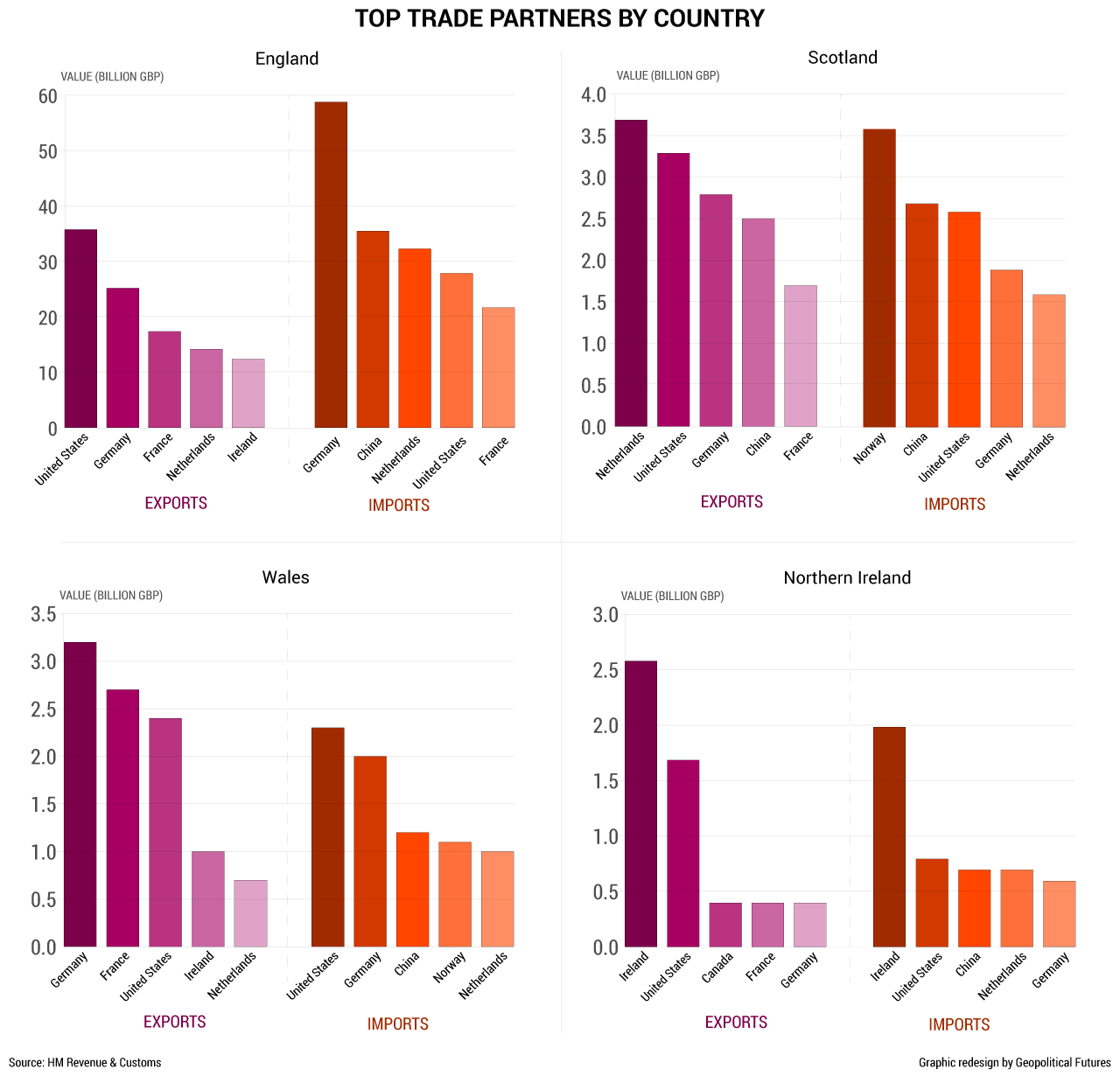

Looking at the top trading partners for each of the countries reveals that EU export markets and EU import suppliers are not as critical as you might expect. Two of Northern Ireland’s largest export destinations – the United States and Canada – are not EU members. In fact, the U.S. is the largest export destination for England, and the second largest for Scotland and Wales. China is also either a top-five export destination or import supplier for each of these countries.

Northern Ireland is a particularly interesting case. It exports more to the EU than it does outside the EU, but it is disproportionately reliant on one member state: the Republic of Ireland. In fact, in 2017, its exports to the Republic of Ireland increased. In the first three quarters of the year, these exports were on track to account for nearly three-quarters of Northern Ireland’s total exports. (Note that this increase in exports may well be a result of the weak pound.) But it’s also true that Northern Ireland’s economy as a whole is not heavily dependent on exports. They account for only 8.9 percent of its GDP. That means that though Northern Ireland is exposed to fluctuations in demand from the Republic of Ireland, it would not be crippled by a downturn in the Irish economy.

Germany, France and the Netherlands are also important markets for each, and in turn, the U.K. is a critical importer of goods from these EU members. Seven percent of German exports, 9 percent of Dutch exports and 7 percent of French exports go to the U.K. – and all of these EU heavyweights have export-to-GDP ratios much higher than the U.K.

Special Collection – The Middle East

Special Collection – The Middle East