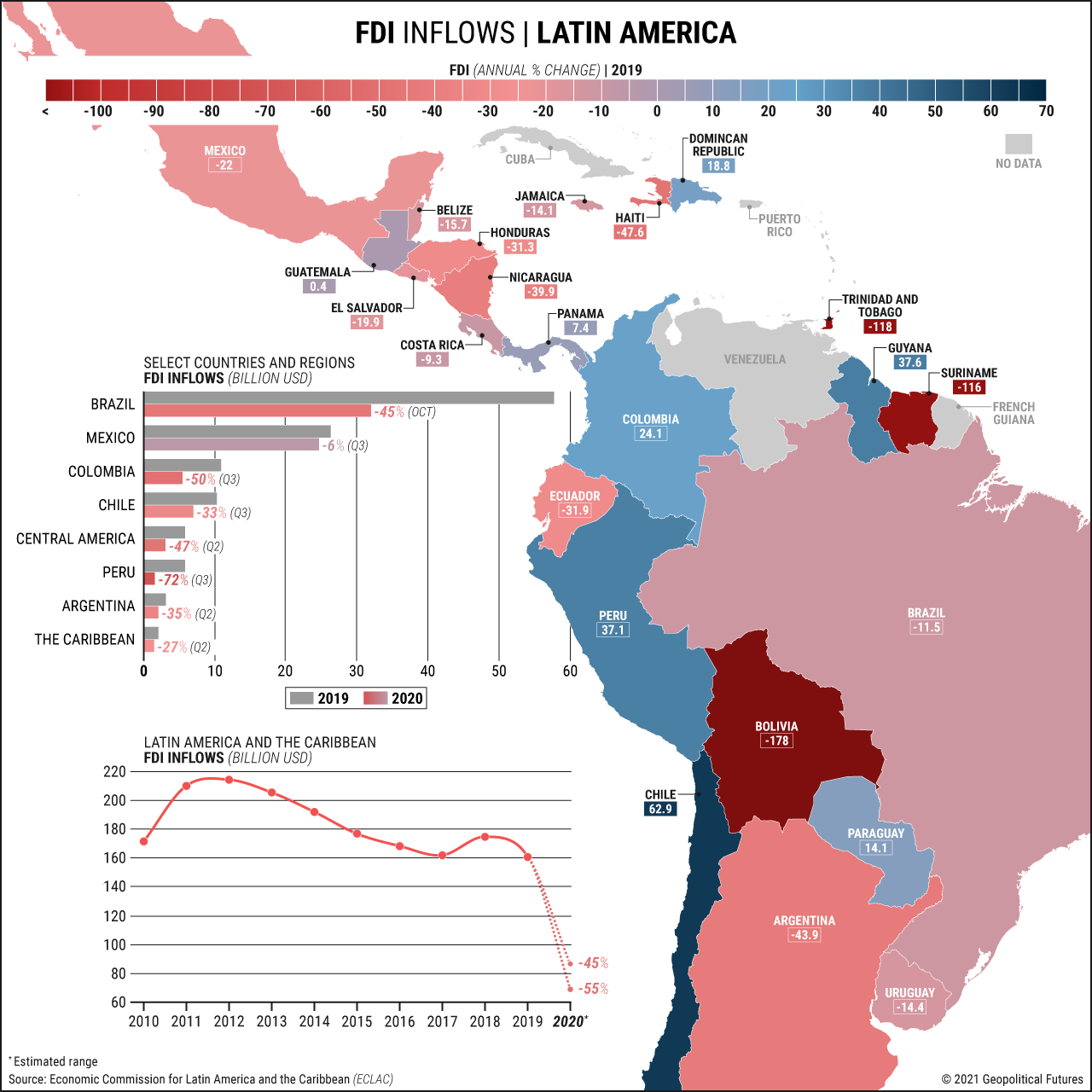

For emerging and developing economies, foreign direct investment plays a crucial role in financing major development projects and growing their economies. This is especially true of Latin America. FDI into Latin America hit historical highs between 2011 and 2012, totaling almost $220 billion and accounting for 14 percent of the global total. But since then, FDI has been trending downward, and in 2019 it dropped by 7.8 percent. The trend wasn’t universal: While Argentina (43.9 percent), Mexico (22 percent) and Brazil (11.5 percent) saw large drops in 2019 compared to 2018, Colombia and Peru saw FDI increases of 24.1 percent and 37.1 percent, respectively.

Final figures for 2020 are not yet available, but FDI plummeted as countries struggled with the economic consequences of pandemic-induced lockdowns. Colombia and Brazil saw large drops in the first half of 2020, with respective declines of 50 percent and 45 percent, or $8.86 billion and $37.26 billion. Argentina and Chile also experienced significant declines. But Peru suffered the worst, with FDI dropping by 72 percent, to approximately $7.3 billion. Mexico fared better, with foreign investment dropping by only 6 percent, to $24.66 billion. Continued low FDI has been forecast for 2021, a trend that is expected to reverse only in 2022.

The Geopolitics of the American President

The Geopolitics of the American President