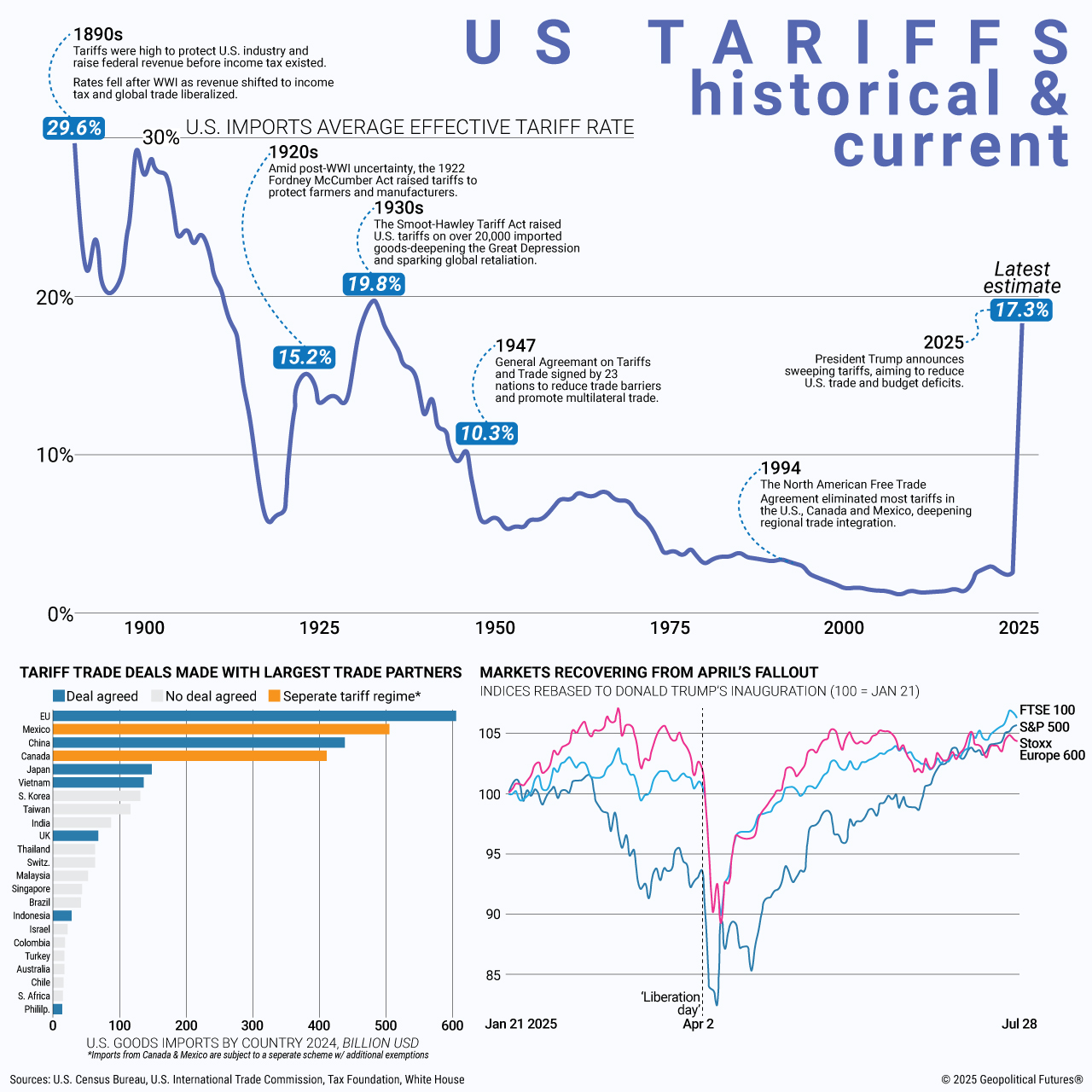

On Aug. 1, President Donald Trump signed an executive order introducing import duties of 10 percent to 41 percent on 69 countries and territories and the European Union. Global stock markets fell accordingly. Yet the reaction is less a result of the tariffs themselves and more a result of volatility and uncertainty; markets believed Trump would not resume the trade war for another few months. Either way, the new tariffs take effect Aug. 7. The deferment period of the past 90 days or so were meant for countries to make new arrangements with the U.S., but only a few trade agreements have been officially reached. Negotiations on others continue.

The use of tariff regulation continues to be a tool of the Trump administration’s foreign policy. The rationale continues to be that tariffs will pressure countries to align with Washington’s newfound interests and will bring unenthusiastic countries to the negotiating table. The downside to this strategy is that it adds instability to the general threat of slowed GDP growth and risks more prices increases in the U.S. market.