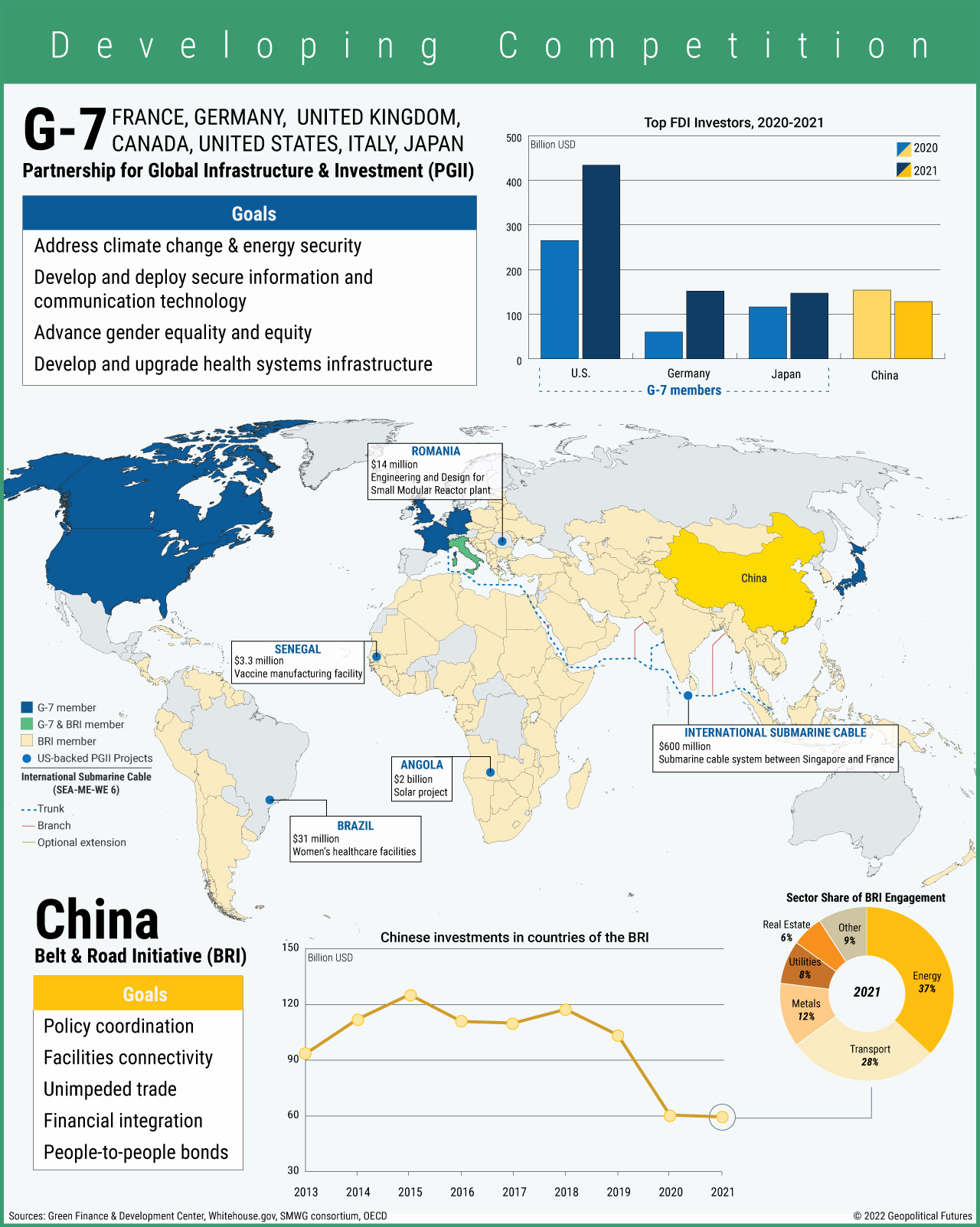

The original strategic impetus for China’s Belt and Road Initiative was to secure trade routes not subject to U.S. control in the South China Sea, to build reliable supply chains for natural resources and to ensure Chinese employment. Since then, it has morphed into a nebulous web of unconnected projects across the globe. Many projects have created debt traps, while funding for others never materialized. BRI took a major hit in 2020 with the pandemic, and it is unlikely to recover anytime soon given China’s mounting domestic economic problems.

The G-7’s Partnership for Global Infrastructure and Investment is a new initiative intended – not solely, but mostly – to serve as the West’s counter to BRI. PGII seeks to support infrastructure development in developing countries, strengthen the global economy and improve supply chain security. Over the next five years, G-7 members hope to mobilize $600 billion in global infrastructure investments, $200 billion of which would come from the U.S. through federal financing and leveraging private sector investment.

Compared to the BRI, PGII projects are smaller in scope and involve greater reliance on private investment. The G-7 hopes to incorporate capital from additional partners, multilateral development banks, development finance institutions and sovereign wealth funds.

The Geopolitics of the American President

The Geopolitics of the American President