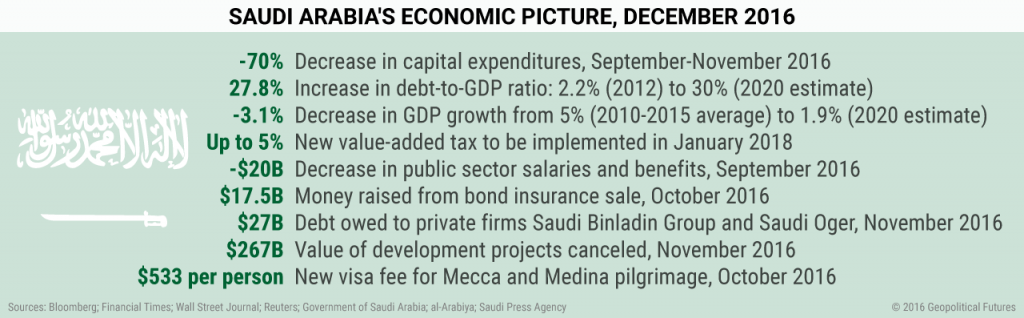

According to Moody’s, Riyadh’s debt-to-GDP ratio was at 2.2 percent four years ago; in 2017, this ratio is expected to balloon to 22 percent, and it is expected to reach 30 percent by the end of the current decade. By 2020, GDP growth will slow to 1.9 percent, down from the 5 percent mark that it averaged during the period of 2010-2015. Saudi Arabia’s mounting financial woes have forced the kingdom to transform its spending by engaging in a major austerity drive. Such measures are typical in most countries but are previously unheard of in the kingdom.

Given the current economic stress, any disagreement within the royal family has the potential to lead to a combination of street agitation and militancy. At present, there are no overt signs that the austerity drive is adversely impacting the kingdom’s political stability. However, since it is likely to be a long while before oil prices return to $90 per barrel (the price at which the Saudis could balance their books), it is reasonable to expect future instability. To read more about the fallout from Saudi Arabia’s economic downslide, check out our Dec. 1 Deep Dive.

Special Collection – The Middle East

Special Collection – The Middle East