Oct. 9 marks the start of London Metal Exchange Week, an annual gathering where members of the global metals community across the entire supply chain discuss market trends and expectations for the year ahead. As part of the event, the U.S.- and U.K.-led Minerals Security Partnership will convene. The 15-nation group formed last year to cooperate on supplies of critical minerals for the green transition. The push will likely spark interest from resource-rich countries like Indonesia, Namibia and Zimbabwe.

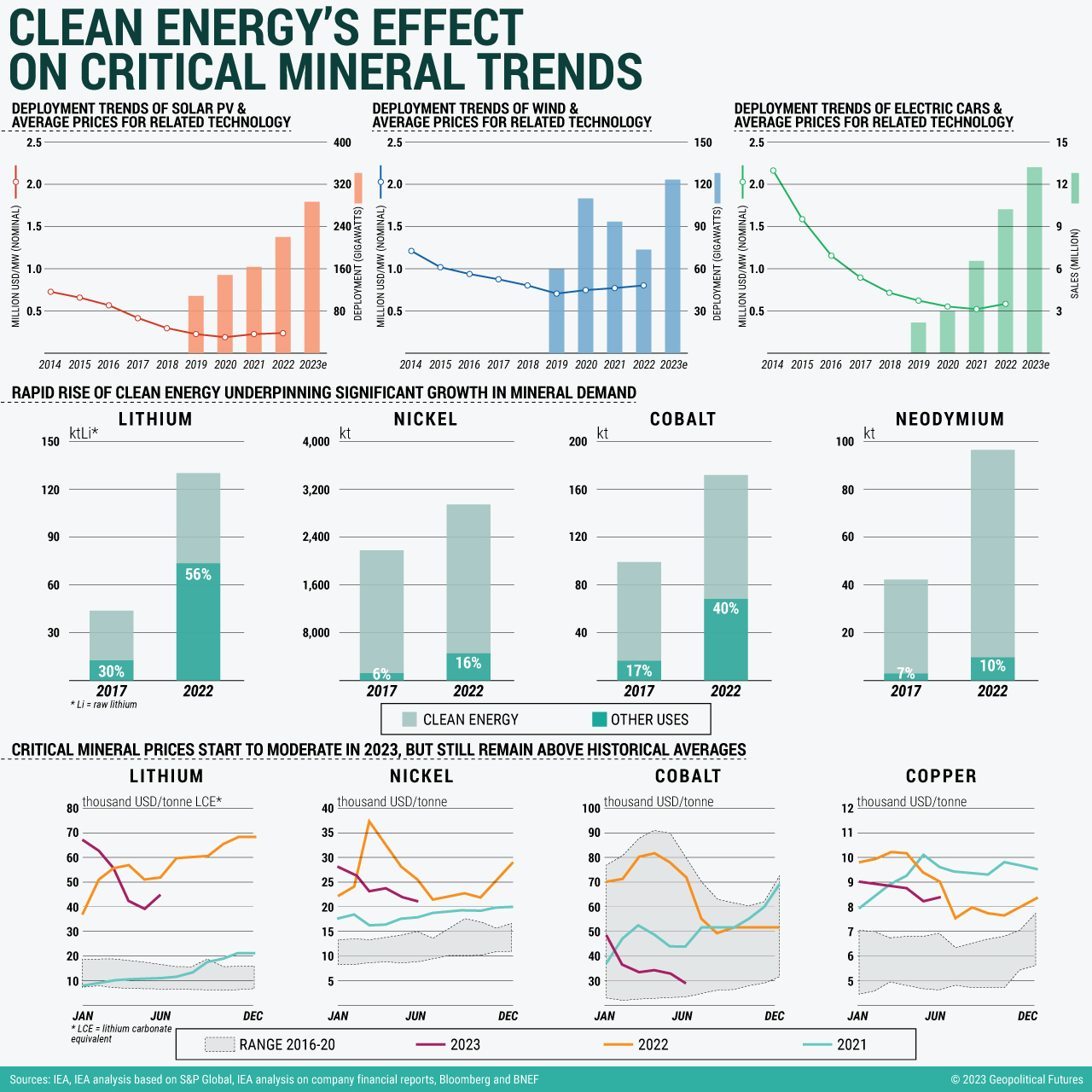

Demand for critical minerals remains high, but volatile prices, supply chain bottlenecks and geopolitical frictions have driven prices higher. They have moderated in recent months but are still above historical averages. Higher materials prices over the past five years have reversed the decadelong trend of falling costs for clean energy technology, according to the International Energy Agency’s clean energy equipment price index. Although these costs are significantly lower than a decade ago, the price spike has led companies to question the economic viability of some solar and offshore wind projects.

Special Collection – The Middle East

Special Collection – The Middle East