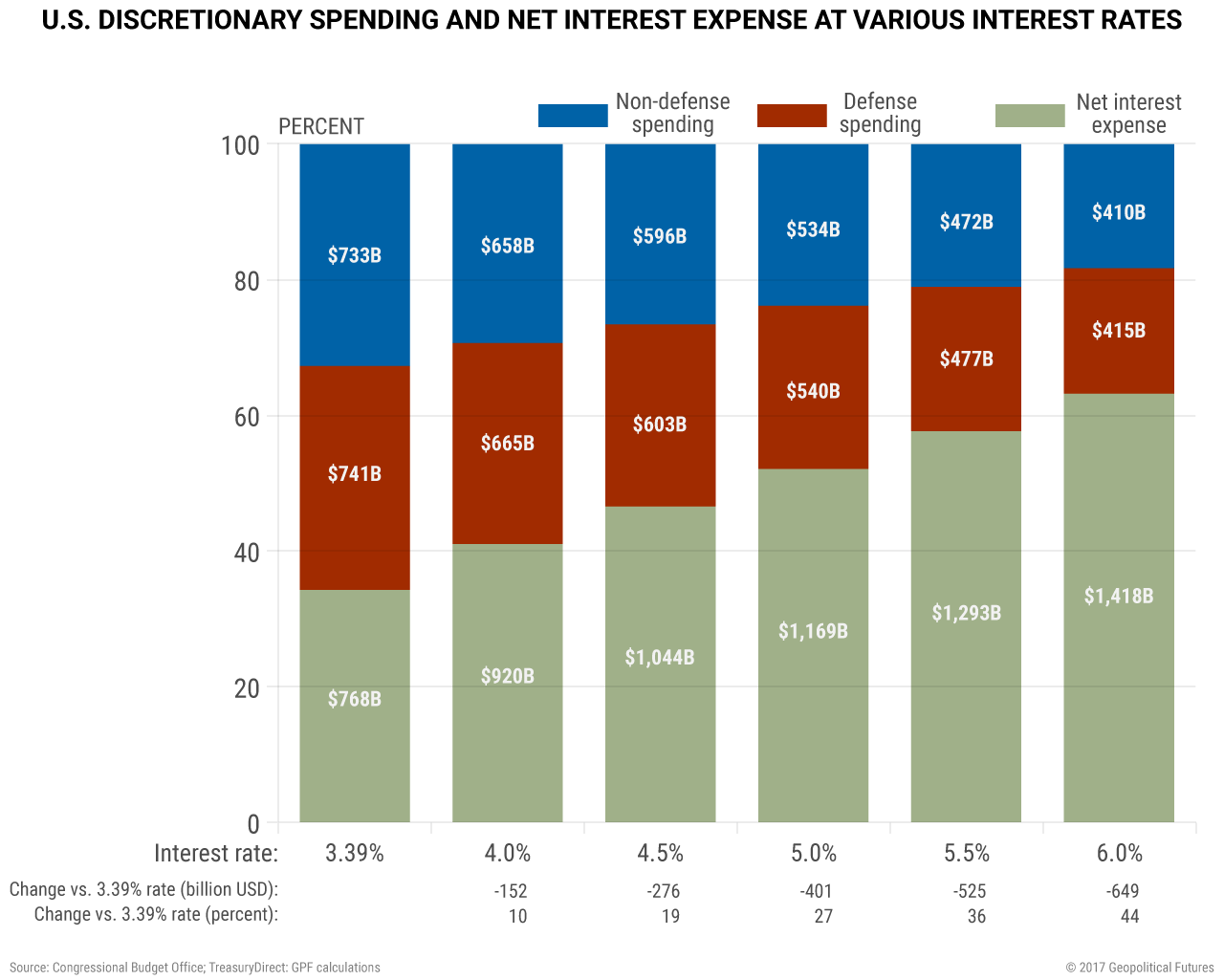

To understand how susceptible the discretionary budget would be to higher interest expense in 2027, Geopolitical Futures built a sensitivity model that shows the decline in the discretionary budget at different interest rates.

Each increase of 50 basis points over official government projected estimates results approximately in a 10 percent decrease in the total discretionary budget. At a 5 percent blended average interest rate, the discretionary budget would be approximately 27 percent lower than the current CBO estimate of $1.5 trillion.

The CBO projects that defense spending will make up approximately 50 percent of the discretionary budget in 2027, which means that defense spending would be vulnerable.

An increase in expected interest rates can force cuts in the defense budget, which would impact the United States’ ability to project power. A significant reduction in defense spending would be unacceptable for the U.S. since it maintains its core strategic interests via overwhelming military strength.

Regardless of the domestic political environment, the government would find a solution that increases revenues since rising interest expense (and therefore reduced discretionary spending) would be a security concern. To find out more about the potential ramifications of U.S. debt, read our recent Deep Dive.