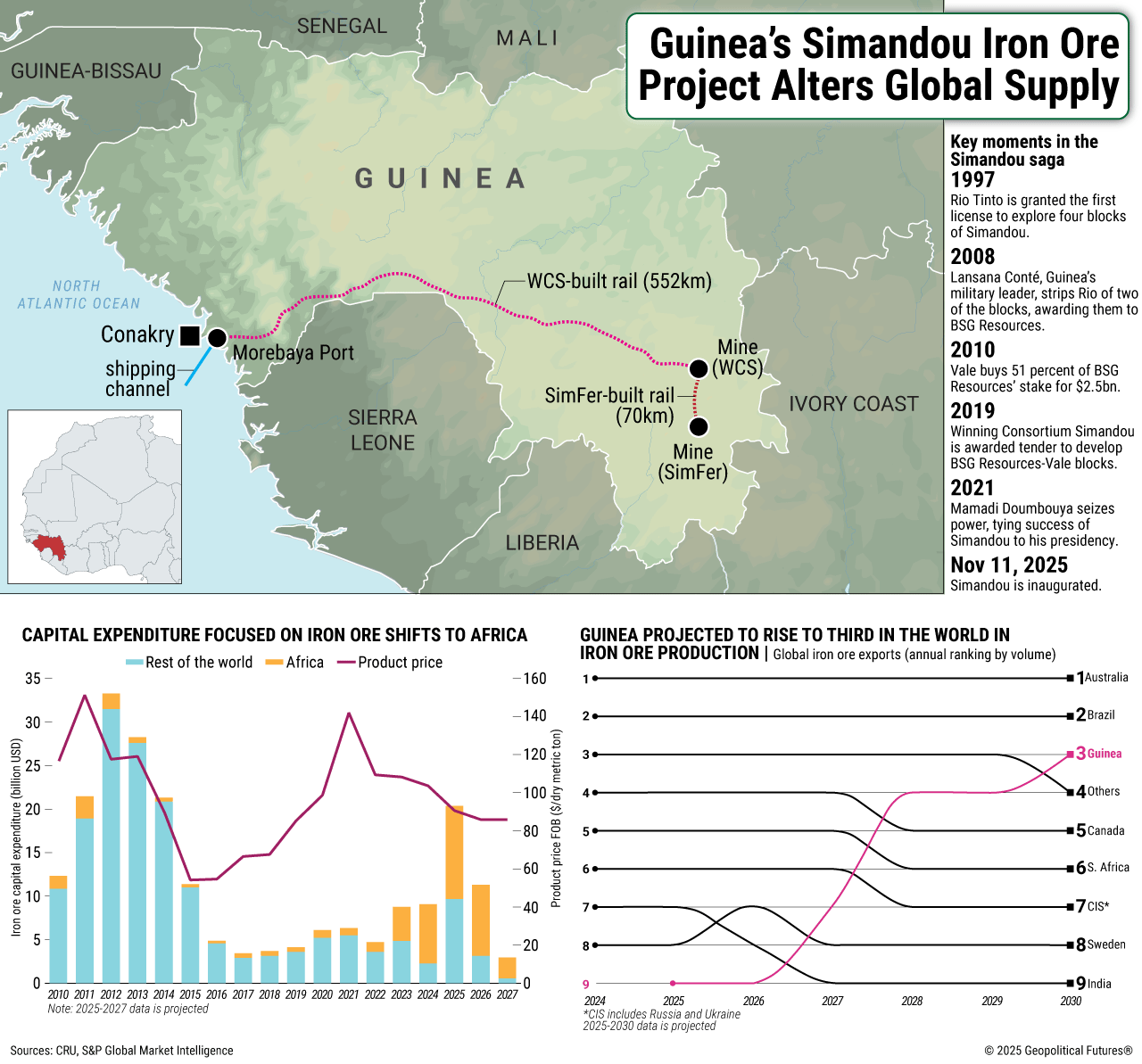

After three decades, Guinea has officially inaugurated the Simandou mine, with the first shipment of iron ore expected to depart for China within weeks. Development of the project began in the late 1990s when Rio Tinto, the Anglo-Australian mining company, first identified industrial-scale deposits in the Simandou mountains. Since then, progress has been hindered by political instability and shifting ownership.

Valued at more than $23 billion, the Simandou project is the largest mining venture ever undertaken. It includes construction of a 552-kilometer (343-mile) railway linking the two new mines in the Simandou mountains to a new deep-water port on Guinea’s coast. Production is projected to ramp up to 120 million metric tons of high-grade iron ore annually by 2030, a level that will significantly reshape global supply. Although Guinea is not currently among the world’s top 10 iron ore producers, it is expected to rise to third place once Simandou reaches full capacity.

For China, the project holds strategic importance. Rio Tinto has supplied iron ore from Australia to China for nearly 50 years, underpinning both economies. In 2024, Australia accounted for 54.3 percent of global iron ore exports, while China imported 73.4 percent of global supply, underscoring their mutual dependence. Simandou’s launch introduces a new supply source that could reshape market dynamics, especially after the recent slowdown in China’s property sector, which reduced steel production by about 5 percent year-on-year. By diversifying its imports, Beijing gains greater leverage in price and supply negotiations with dominant producers like Rio Tinto. For Guinea, meanwhile, the mine opening looks to build on its success as the world’s largest bauxite exporter, another sector transformed by heavy Chinese investment.