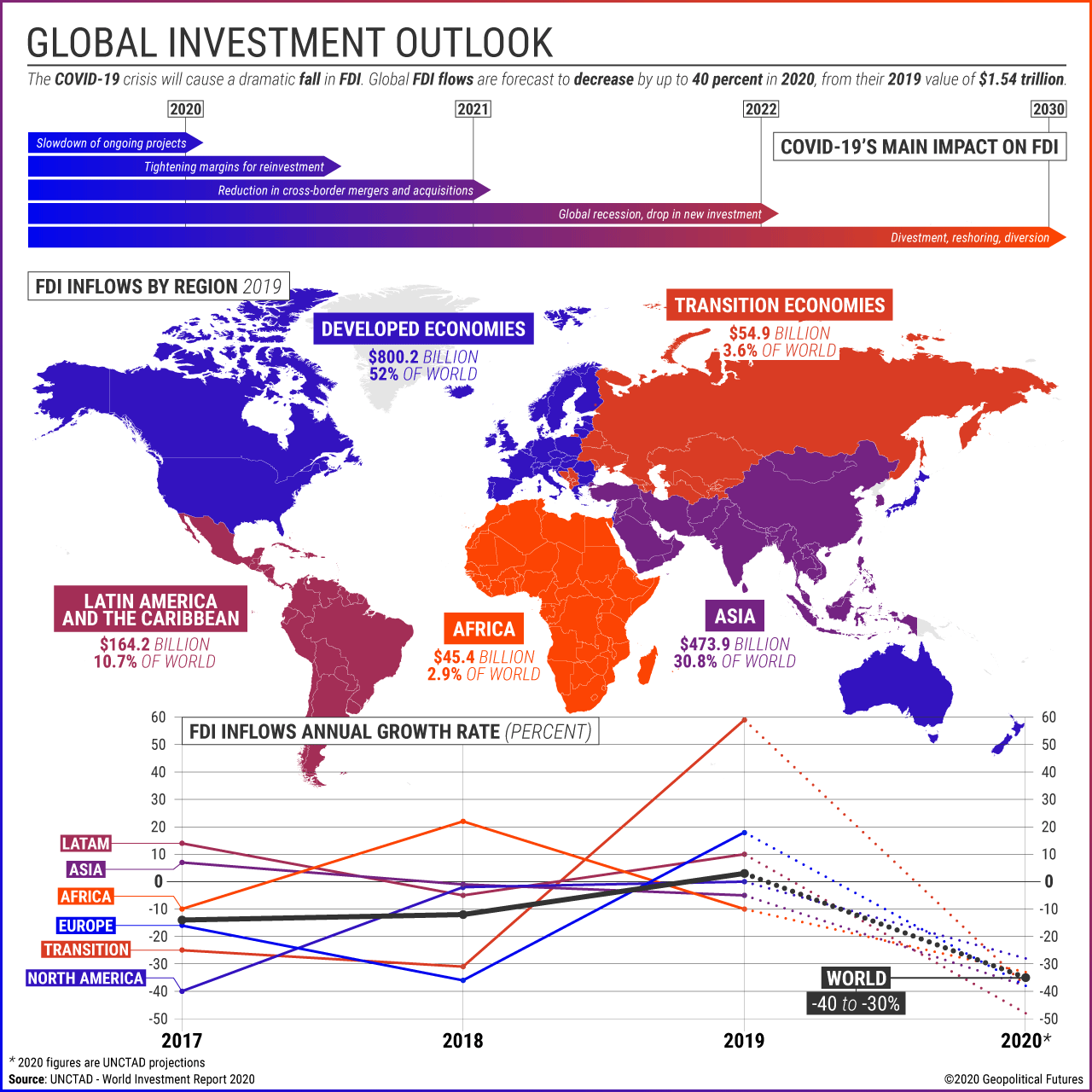

Given the growing geopolitical tensions in a number of regions around the world and the challenging economic conditions, 2020 never promised to be a good year for global investment and trade. The coronavirus pandemic, however, exacerbated the issue to say the least. And with the release last month of the U.N. Conference on Trade and Development’s annual report on global investment, we have an indication of just how much the pandemic may affect the global investment environment. The organization’s forecast takes into account the lockdowns and supply chain disruptions in East Asia, as well as the decline in revenue for major multinational companies.

According to the report, the COVID-19 crisis will cause foreign direct investment to decline by up to 40 percent in 2020 and another 5-10 percent in 2021. It points to coronavirus containment measures that led to the suspension of existing investment projects as well as efforts to shift production to meet domestic needs as the reasons for the decline.

FDI is projected to decrease in some regions more than others; it all depends not only on how quickly countries can return to “normal” after lockdown but also on their economies’ performance before the pandemic. FDI in Europe is expected to decline significantly more than in North America and other developed economies, while FDI in Latin America and the Caribbean is expected to be cut in half because of their relatively more fragile pre-crisis economies.

UNCTAD says that the outlook remains highly uncertain, but it predicts that FDI will return to pre-pandemic levels in 2022. Investors are likely in no hurry to revive investments, as many are expecting a second wave of infections. Global investment levels will depend on how long the pandemic lasts and the effectiveness of political measures to mitigate the economic consequences.

Special Collection – The Middle East

Special Collection – The Middle East