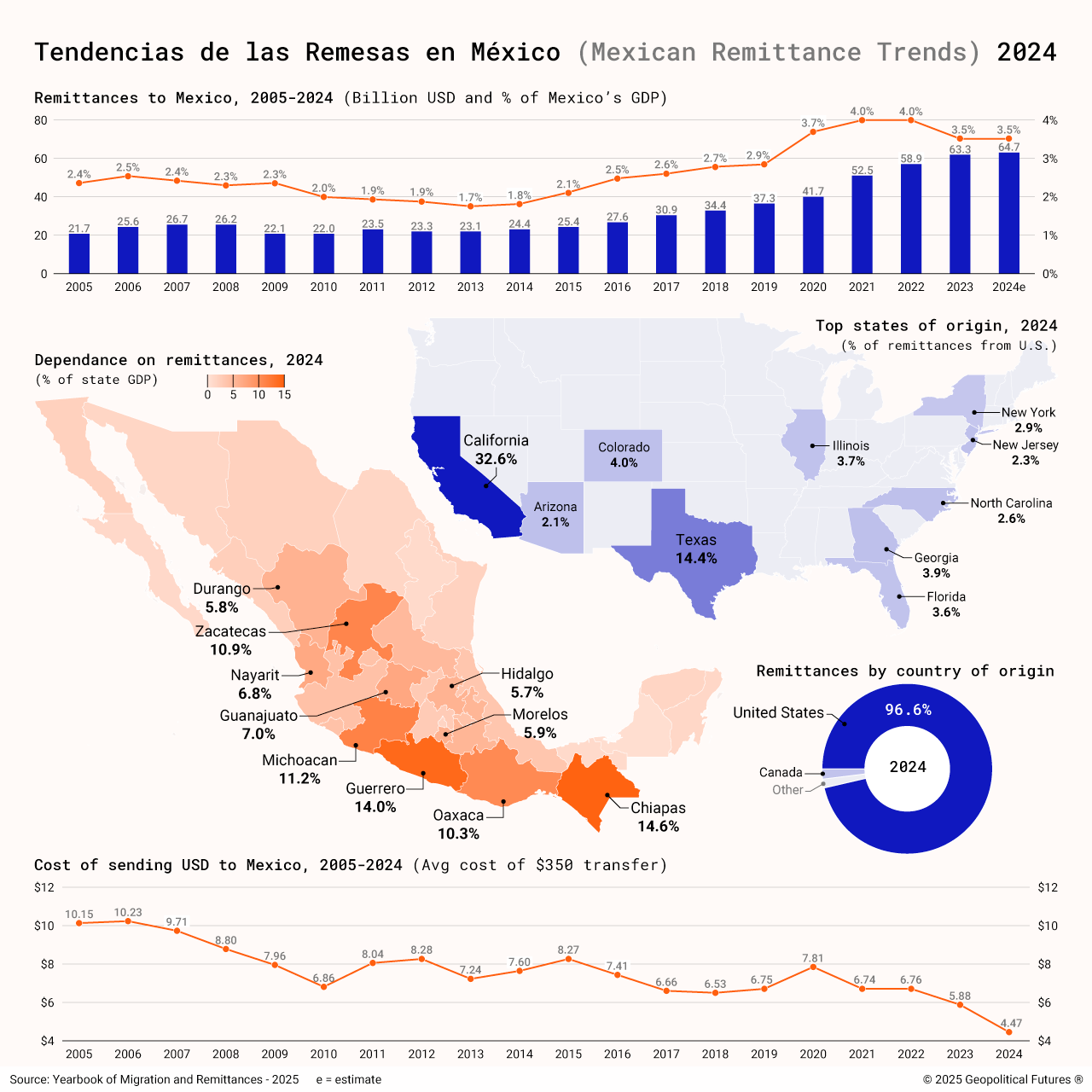

Remittances play a critical role in the Mexican economy. Since 2015, total annual remittances to Mexico contributed more to Mexico’s gross domestic product than revenue from oil exports. Since 2019, income from remittances represented a larger share of Mexican GDP than did foreign direct investment. Many households in Mexico’s poorer southern states rely on remittances to meet their basic needs. Starting Jan. 1, 2026, the U.S. government will place a 1 percent federal tax on all outgoing remittances and will be charged to U.S. nationals, green card holders and non-citizens who send payments. The tax will apply to cash-based in person payments like money orders, cashier’s checks and other similar instruments. It will exempt electronic fund transfers from U.S. accounts and those funded by a U.S. debit or credit card. Though the 1 percent tax rate is much lower than the initially discussed 5 percent and 3.5 percent rates, concerns remains over the potential impact it may have on income flows to Mexico’s southern states. In addition to exploiting the exempted transfer methods, those sending remittances may also start exploring other methods such as cryptocurrencies that that are more difficult for the U.S. to track.