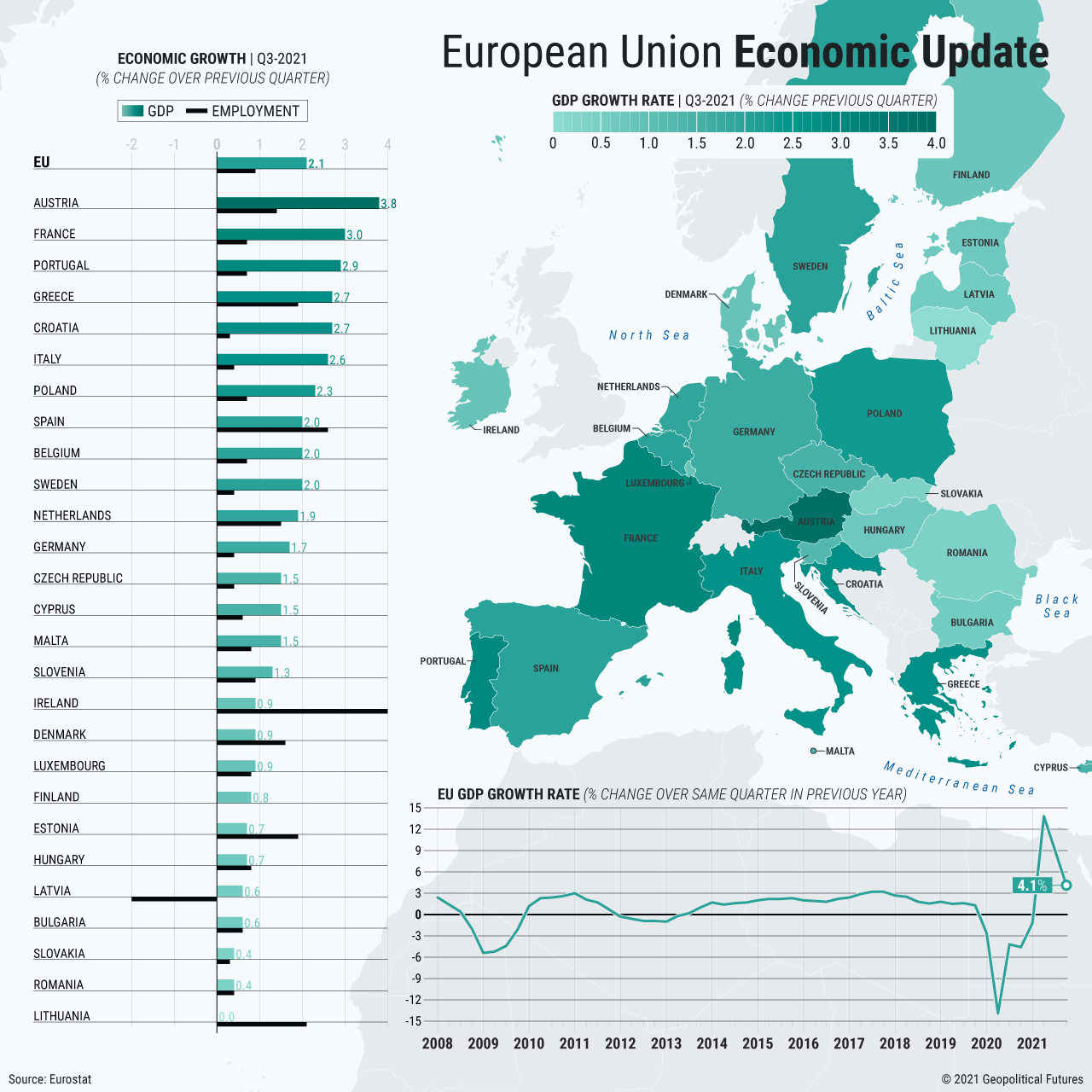

Two years after the beginning of the COVID-19 pandemic, the economy of the European Union is rebounding, with growth in most EU states returning to pre-pandemic levels. After the initial uncertainty surrounding the omicron variant, most EU states are lifting or are about to ease pandemic-related restrictions, and economic activities are regaining pace, as shown by recent better-than-expected industrial production data. Even unemployment is at record lows in the bloc and especially in the eurozone.

However, there are some potential headwinds. First, inflationary pressure, especially in the energy sector, is getting too strong to ignore, to the extent that monetary authorities are starting to assess that it might not be just a temporary phenomenon. The European Central Bank, for example, has been reducing the pace of its asset purchasing program, and some central banks in non-eurozone members are raising interest rates to limit the effect of soaring prices. And as employment is reaching pre-crisis levels, another problem has emerged: labor shortages, in particular in services and construction. Finally, all these factors are affecting EU member states in different ways, making it difficult to reach common solutions. For these reasons, the European Commission – the executive branch of the bloc – has recently cut its growth forecast for the European economy.

Special Collection – The Middle East

Special Collection – The Middle East