Originally produced on Dec. 19, 2016 for Mauldin Economics, LLC

George Friedman and Jacob L. Shapiro

Last December, Geopolitical Futures published its first annual global forecast, which was written before we opened for business. December has come once more, and for us that means two things. First, it means writing our forecast for 2017, which was published last week on our website. We will be sharing elements of our forecast with this audience over the next few weeks. Second, it means grading ourselves on how we did the previous year.

As we have said in the past, forecasting requires constant self-examination. We consider it our responsibility to our readers to evaluate our work. Our readers know whether we made mistakes, and write emails telling us when we do, so there is little point in trying to hide them. Hiding our mistakes from our readers would mean hiding them from ourselves.

We have defined our grading system as follows:

A: Forecast fulfilled

B: Forecast on track, but not yet fulfilled

C: No movement toward fulfillment, but still likely or at least possible

D: Significant failure in forecast

F: Forecast wrong

NF: Not forecast

Last week, we started a series on our forecast for 2017. This week, instead of focusing on a section of that forecast, we wanted to share part of our self-assessment for the 2016 forecast.

If you want to see the full report, you will have to subscribe to our service. It includes both a report card with grades and comments and a longer document analyzing our most important forecasts for 2016.

Overall, we considered our forecast for 2016 to be largely successful. We had no significant failures, though we gave ourselves a grade of “NF” for some developments. In what follows, we evaluate three of the most notable forecasts, as well as one outlier.

Italy’s Banking Crisis: B

We said that Europe’s fundamental economic issues would continue in 2016, and that the drama would move from Greece to a far more daunting challenge: Italy. We wrote the following at this time last year:

Italy already has a major unemployment problem in the south. It is now facing a rising rate of non-performing loans—loans that are not being paid back. Businesses that have survived on reserves have exhausted those reserves. Whatever the cause, Italy will be facing serious banking problems in 2016. How serious they are will depend in large measure on how rapidly the rest of Europe recognizes the problem and is willing to create solutions. Given Europe’s track record, speed is unlikely, and this can create a crisis far more challenging than Greece’s later in the year.

At the time, Italy’s banking sector was not attracting much public attention, even though “bail-ins” had to be applied to four small Italian banks in November 2015. But just a few weeks after we released our forecast, an Italian pensioner—who had his savings wiped out by the Italian government’s rescue plan—hanged himself, making national headlines in Italy.

From there, the story would pop up occasionally, such as when the European Central Bank asked to review the balance sheets of some of Italy’s largest banks, or when the European Commission and Italian government negotiated ways Italy could offload its bad debt.

By summer, the mainstream media began to recognize the Italian crisis. The economic consequences of the banking crisis began to transform into political ones. Then Italian Prime Minister Matteo Renzi and German Chancellor Angela Merkel clashed over their differing imperatives, and Renzi resigned after losing a referendum on his proposed constitutional changes just this month.

We gave ourselves a B on this forecast, not because we were wrong; this forecast is certainly on track. We just don’t think it has been completely fulfilled yet. We expect the political drama in Italy to increase now that Renzi has resigned and the high level of non-performing loans continues to be a large concern.

The Endurance of the Islamic State: A

When we published our 2016 forecast, both the US government and mainstream media confidently claimed that 2016 was going to be the year the Islamic State would lose control of its caliphate. Most of these reports were accompanied with an impressive sounding figure describing how much territory IS had lost to its enemies.

We, however, wrote the following:

American efforts against the group are unlikely to yield the desired results in the coming year. It is possible that IS could suffer tactical setbacks, but strategically dislodging it will be extremely difficult because there are limits to how much air power can accomplish and Washington lacks reliable partners on the ground.

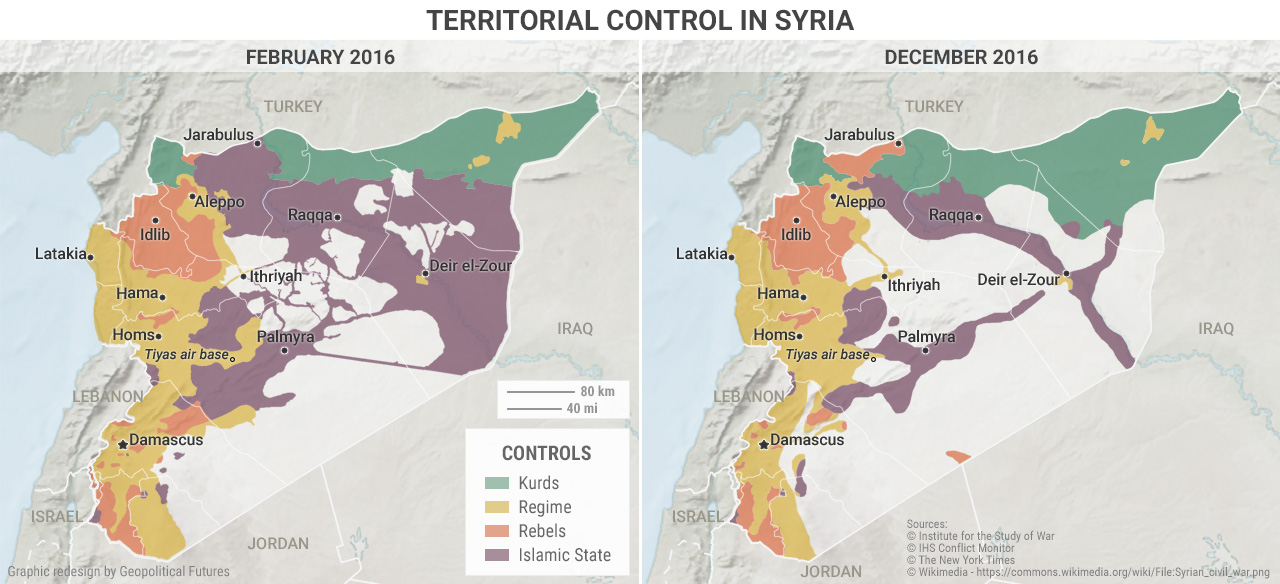

As you can see from the graphic above, IS has lost some territory over the year. This map only depicts IS control in Syria, but its holdings in Iraq have also been curtailed. But using this as a measure is misleading. If you follow our writing regularly, you will know that we have identified the center of gravity for IS as the area between Raqqa and Deir el-Zour. IS, for all its brutality, is a sophisticated entity that has shown time and again its willingness to retreat from less important strategic positions to make its core areas more defensible.

That, in a nutshell, is what 2016 has been about for IS—resisting attacks, pulling back to borders it can defend, and occasionally engaging in opportunistic counterattacks. Last week, IS retook Palmyra, a city from which IS withdrew earlier this year after being challenged by Syrian, Iranian, and Russian forces.

IS’ strategy to regain control in Palmyra is typical of a well-integrated command structure—go on the defensive in one location (Mosul), shift armor and resources to another location (Palmyra), and attack. For IS, 2016 has been consistent with what we projected.

China’s Dictatorship Intensifies: A

The economic and political processes that are reshaping China right now will take longer than a year to fully develop. We have been pointing out the limits of China’s high-growth model for many years now. 2016 was just another chapter in that process, one in which we expected a certain level of economic instability—but also success for President Xi Jinping in asserting his rule as a dictator.

We wrote in our 2016 forecast:

Our forecast for the coming year in China is that the current growing dictatorship will moderately intensify, and the underlying economic problems will grow as well with more spasmodic events, such as the 2015 stock market collapse or sudden revaluation. The Chinese will use the South China Sea as a means of increasing nationalism in the country and legitimizing the Communist Party’s rule. … [W]e do not expect the South China Sea to consist of more than demonstrations and feints on either side.

This forecast bore fruit at the beginning of the year as the first weeks of 2016 saw a fresh crisis in the Chinese stock market and capital outflows of almost $200 billion resulted in December 2015 and January 2016.

This year, China’s deep underlying economic problems have manifested through the ongoing depreciation of the yuan, capital flight, and—counterintuitively—the country’s booming housing market. Issues also are mounting related to local government debt and corporate debt.

Meanwhile, at the political level, Xi has continued to assert his authority. The anti-corruption campaign has increased in scope and intensity. Xi has tightened his grip on the People’s Liberation Army, reorganizing its structure, replacing its commanders, and setting up a special commission to investigate corruption in the military. Later in the year, Xi was declared the “core” leader of the Chinese Communist Party, demonstrating growing loyalty and obedience in response to his moves.

Meanwhile, China has sought to distract from these economic and political developments by saber-rattling in the South China Sea, though these moves are little more than hot air. Our long-term forecast for China is pessimistic about the central government’s ability to keep this up forever, but in the next few years, we expect a strong Xi to keep these forces from exploding.

Brexit: NF

Our work focuses on geopolitical dimensions. Geopolitics involves looking at political, economic, and military forces under one category as the distinctions between these are illusory. We create our forecast by trying to grasp the imperatives and constraints under which decisions are made.

At a certain level—such as predicting what happens in the EU, Russia, China, or the United States—political power is so constrained that the wishes of leaders have little to do with what will actually happen.

This allows us to understand the world deeply, but this method has limits. Some events simply cannot be forecast. We had no idea, for example, that Britain would vote by a 4% margin to leave the European Union or that Renzi would end up losing the referendum in Italy. (And one of the key things that emerged in 2016 is that pollsters didn’t see these events coming either.)

What we did say was the EU would face intense tests in 2016 and that it would become hopelessly mired in its institutional failures. From our point of view, Brexit confirmed that forecast, but the outcome of the referendum could not be predicted.

So, had the United Kingdom voted to remain in the EU, or had Renzi been successful in the referendum, our forecast still would have been fulfilled just by the fact these votes were much closer than many anticipated. Had Brexit been soundly defeated, that would have amounted to a challenge to our forecast, but it wasn’t.

Events like Brexit have also forced changes in political postures from establishment parties throughout the Continent. We are already beginning to see this play out in the lead-up to elections in Germany and France, where candidates associated with internationalist positions are being forced to move toward a more nationalist position.

Merkel, for example, may win re-election in 2017—but she has already had to modify her positions on refugees and other issues. This is a process we identified in our 2016 forecast, but we don’t presume to know all the ways it will manifest.

The Importance of Self-Assessment

This process of self-examination is not just for the benefit of our readers. It is the most basic part of forecasting. When you start lying to yourself in strategic intelligence, you’re on the path to disaster. The mind gets accustomed to seeing certain patterns, and over time, the mind can start to deny changes in patterns if they go against expectations or to interpret events in a way that fits with expectations.

The hardest part of forecasting is not understanding the future, but accurately evaluating the present. In this brief snapshot, we’ve tried to give you a feel for not just how we forecast, but how we judge our own work. If you’re interested in knowing more, you can find more on our website.