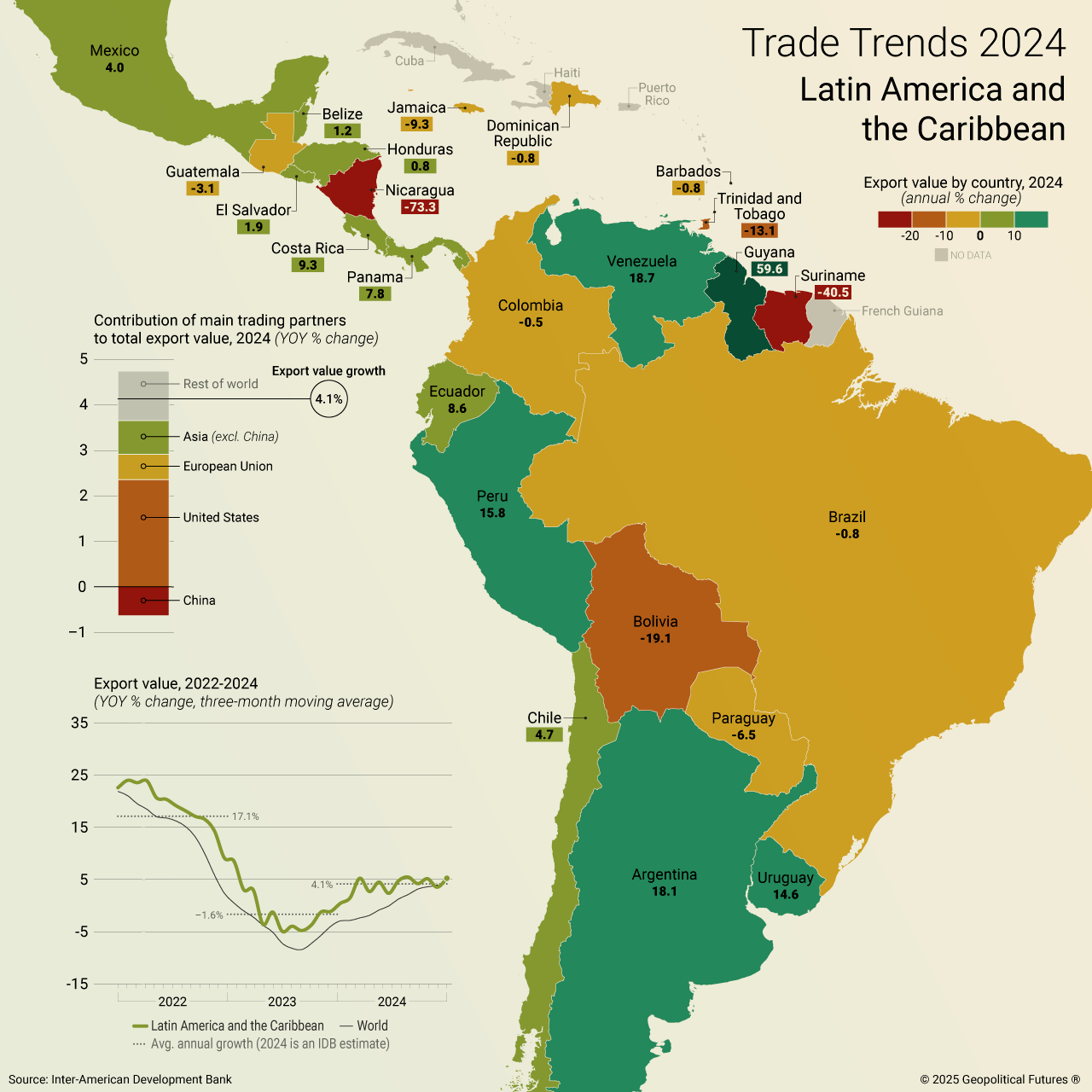

Last year, several countries across Latin America and the Caribbean saw substantial swings in export numbers. Argentina experienced an 18.1 percent increase over the previous year, due in part to economic reforms. Since taking office in 2023, President Javier Milei has introduced significant changes meant to revitalize the economy by deregulating certain sectors, cutting subsidies, privatizing state companies and relaxing labor laws.

Guyana saw the biggest bump in exports (59.6 percent), driven by rising oil output. It was the country’s fifth consecutive year of double-digit growth. In Peru, the rising global demand for minerals, which the country produces in abundance, helped propel 15.8 percent growth in exports. The spike was also aided by Peru’s diversification of its trade partnerships, which include the United States and the European Union. Meanwhile, Venezuela’s recovering oil sector drove an 18.7 percent rise in exports.

Not every country performed so well, however. Nicaragua’s exports declined by 73.3 percent, amid growing U.S. economic pressure over human rights concerns.

The United States remained the region’s top trade partner, while countries that have strained relations with Washington (including Nicaragua, Suriname and Bolivia) saw declining exports. Though demand for the region’s natural resources was not as high as it was in 2022, there was a notable improvement from 2023. Overall, the region experienced a marked recovery in trade.