For decades, Russian exports centered on raw materials, primarily oil and gas, with the European Union as the key buyer. Oil revenues directly funded Moscow’s budget, making the halting of exports a potential pressure point on the Kremlin. The West attempted to exploit this after Russia’s invasion of Ukraine by imposing a price cap (above which Western insurers were banned from providing their services) and an embargo on Russian oil, all aimed at cutting off funds for Russia’s military.

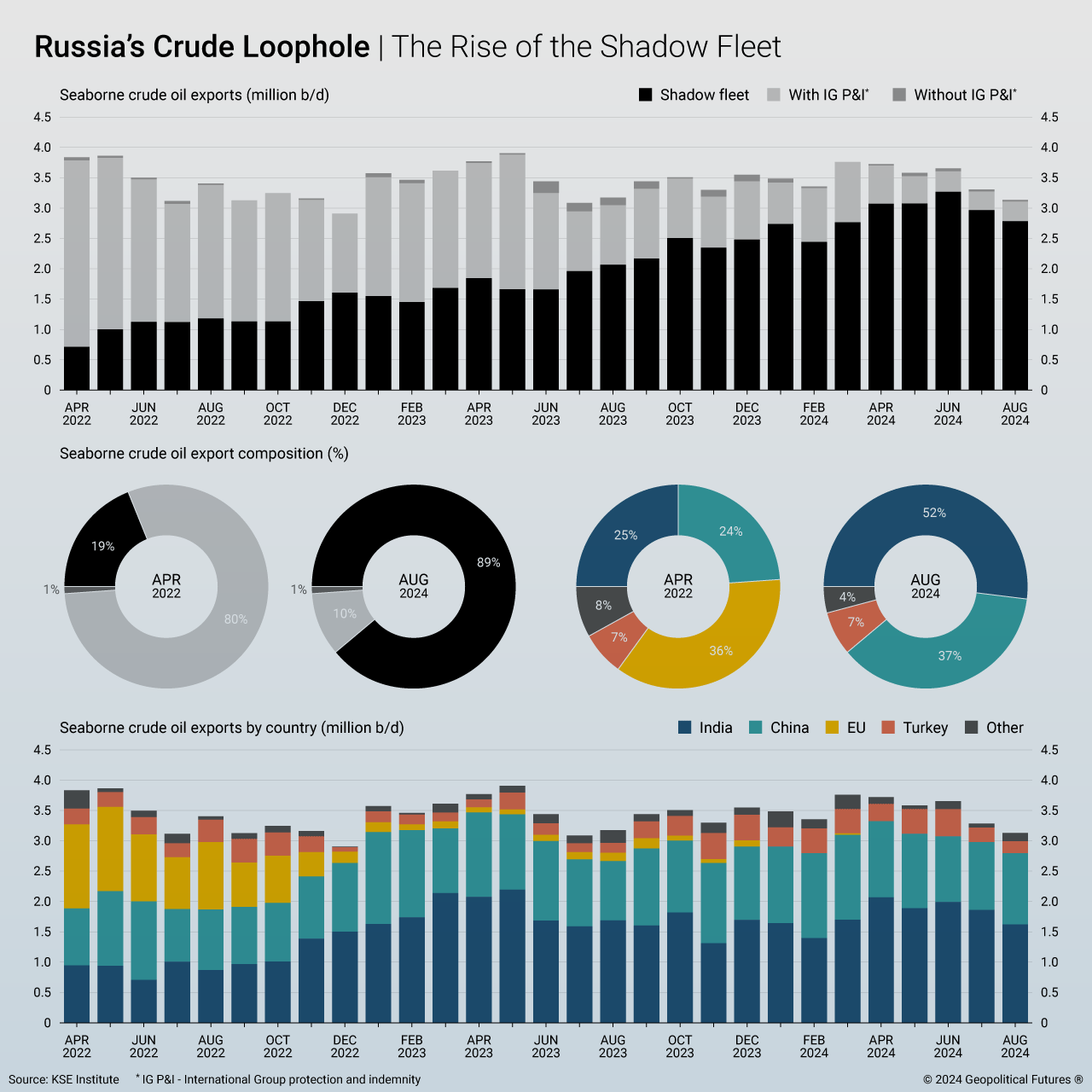

However, ongoing demand for Russian oil and Moscow’s ability to maintain supply pushed part of the business into the shadows. Europe’s reliance on Russian energy, particularly gas, meant an immediate halt to the relationship was unfeasible, and Russia wasn’t willing to sacrifice revenue or market share. This led to the rise of a “shadow fleet” to keep oil flowing. By early 2024, Russia had acquired more than 600 old tankers to continue these operations. Market dynamics in the region have been slow to change, but the shadow fleet remains vulnerable to further sanctions, especially by the U.S.