Originally produced on July 31, 2017 for Mauldin Economics, LLC

By George Friedman, Xander Snyder and Ekaterina Zolotova

The US Congress has passed new sanctions targeting Russia’s energy companies. Among the other notable aspects of the sanctions is that they take some authority away from the US president (who used to be able to implement some measures but not others at his discretion) and give it to Congress.

Recognizing that a vital sector in its economy has even less chance of relief than it once had, Russia has retaliated. It has reduced the number of diplomats it has in the US and has seized property used in Russia by US diplomats.

Energy sales are an important source of revenue, of course, but for Russia they are more than that: They are an instrument of geopolitical power. They give Moscow considerable influence over the countries whose energy needs are met by Russian exports. If Russia intends to retaliate further against the US, its energy supplies, especially those it sends to Europe, may be its best option to do so.

Deliberate Dependence

But exactly how much oil does the rest of the world import? How can Russia use this to its advantage?

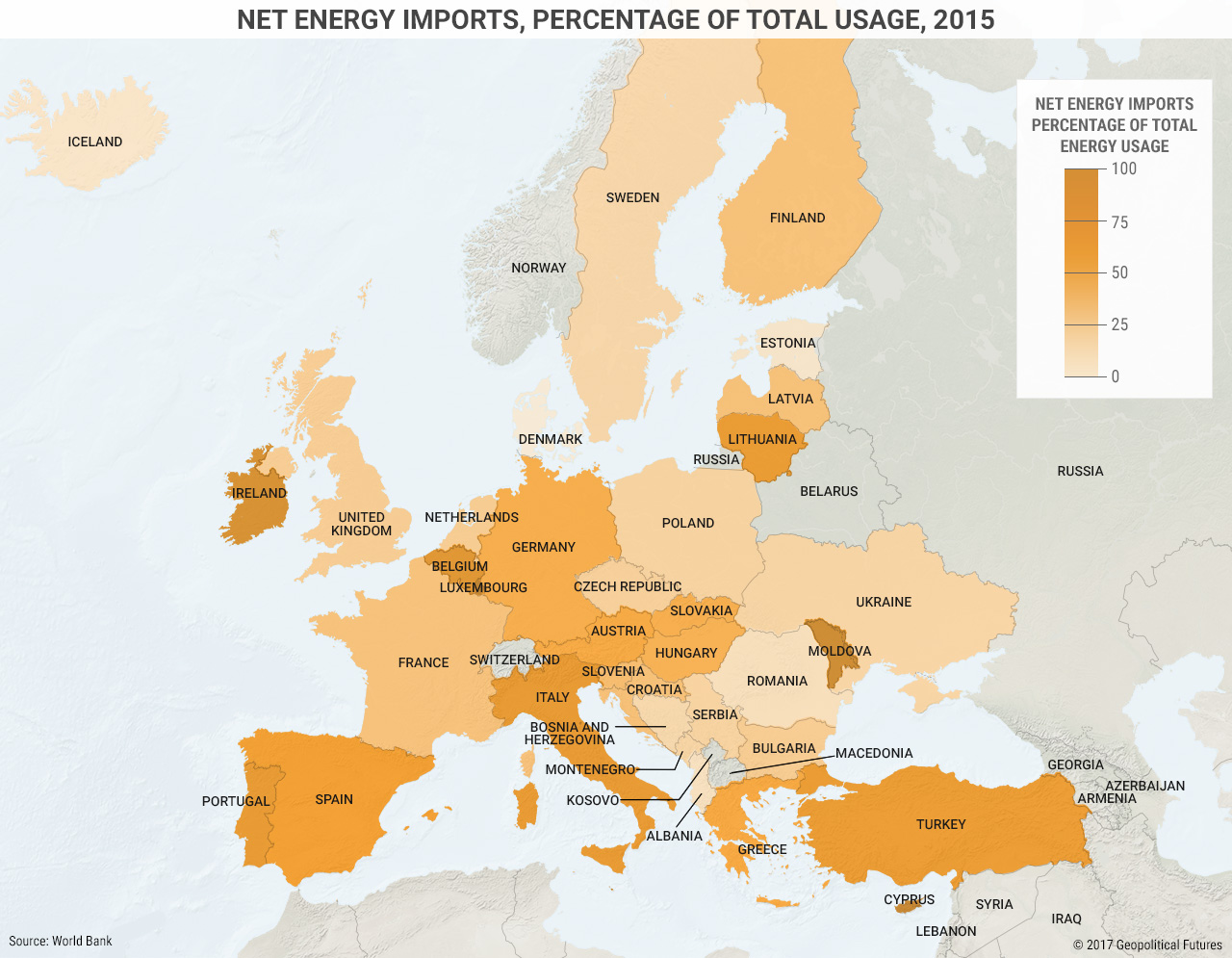

Collectively, the European Union imports 53% of the energy it consumes. This includes 90% of its crude oil and 66% of its natural gas—a higher percentage than most other regions of the world, including North America, East Asia (but not Japan), and South Asia. All told, energy accounts for 20% of all EU imports.

Individually, some countries rely more on energy imports than others. Most European countries import more than 30% of the energy they consume. Norway provides roughly 35% of these imports, while Russia provides roughly 40%. Germany, which boasts the largest economy in the EU, imports more than 60% of the energy it consumes, and France, which boasts the third-largest economy, imports about 45%.

Some Eastern European countries are even more dependent on foreign energy. Hungary, Austria, and Slovakia import approximately 60–65% of their energy needs. Bulgaria, the Czech Republic, and Romania, however, import less (37%, 32%, and 17%, respectively). In the Baltics, Lithuania imports roughly 75% of the energy it consumes. Latvia imports 45%, and Estonia imports 9%.

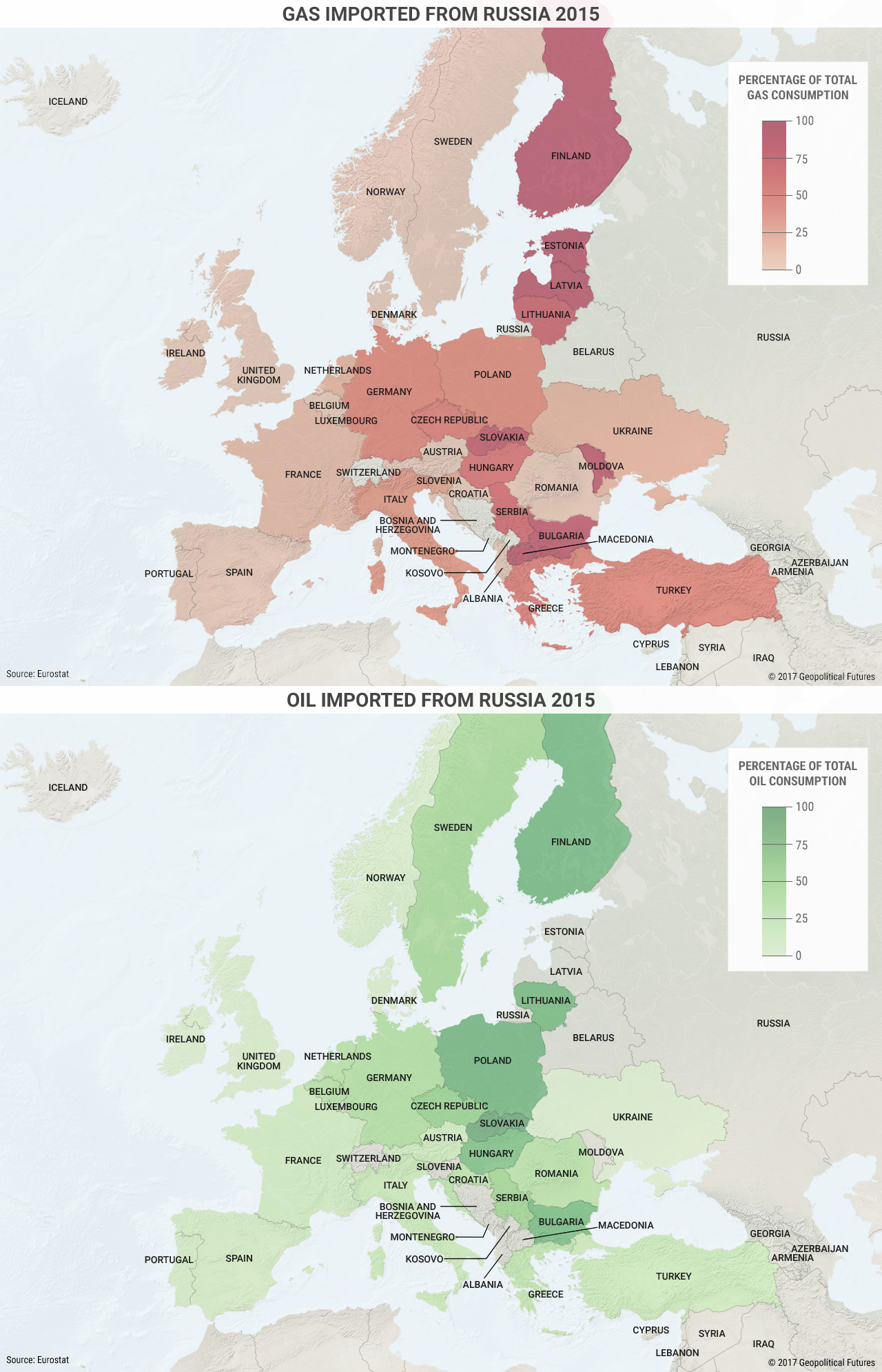

Most of this energy comes from Russia. In fact, Russia provides more than 70% of the oil and natural gas used in Bulgaria, Latvia, Lithuania, Hungary, Slovakia, and Finland. It provides 62% of the natural gas and 56% of the oil used in the Czech Republic, and 53% of the natural gas and 90% of the oil used in Poland.

Cultivating this dependency is a conscious move on behalf of Russia. Russia’s core security imperative is to maintain a buffer space between it and Western Europe that would help it repel any invasion, which it accomplished during the Soviet era by invading and occupying countries. Russia is not as powerful as it used to be, but it has developed economic leverage that enables it to exert pressure over countries that could pose a danger to it by threatening their energy security.

Aware of how dangerous a dependence on Russia can be, these countries are trying to diversify their energy sources accordingly. Poland and Lithuania, for example, have begun to import liquefied natural gas from the United States. This is a longer-term solution, however, since importing LNG requires the development of specialized infrastructure to receive and transport it.

The Best Bet

France and Germany—the de facto, if often irreconcilable, leaders of the European Union—illustrate how Russian energy can shape foreign policy. France may rely heavily on foreign energy, but most of its oil and natural gas comes from Algeria, Qatar, Saudi Arabia, and Libya—not Russia. France can therefore afford to be more aggressive and supportive of sanctions against Russia.

Not so with Germany, which receives 57% of its natural gas and 35% of its crude oil from Russia. Berlin must therefore tread lightly between its primary security benefactor, the US, and its primary source of energy, Russia.

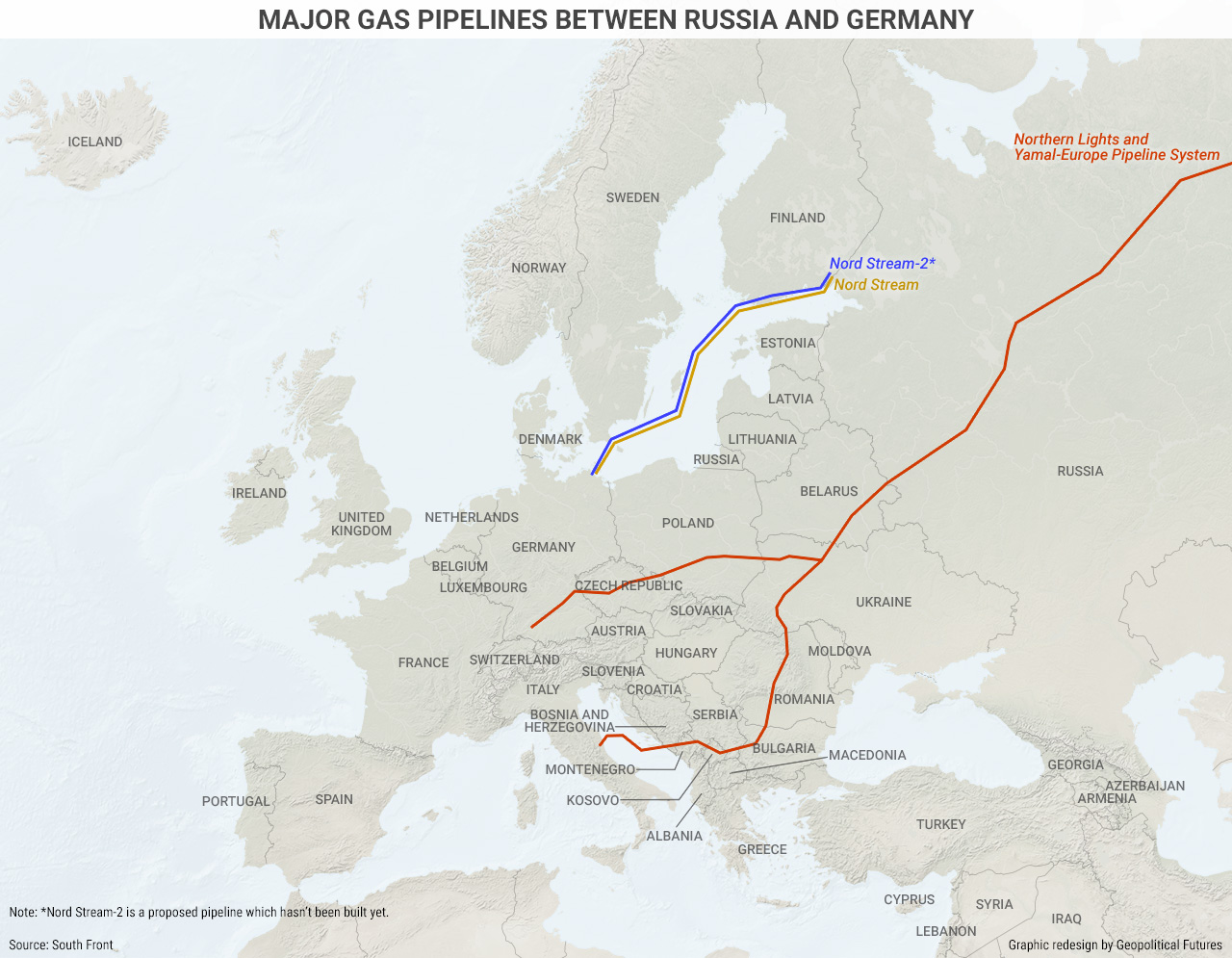

This is one reason Germany has been such an outspoken critic of the recent US sanctions, which penalize businesses in any country that collaborate or participate in joint ventures with Russian energy firms. Germany supports the construction of Nord Stream 2, a pipeline that would run through the Baltic Sea, circumventing Ukraine—the transit state through which Germany currently receives much of its energy imports. The pipeline would help to safeguard German energy procurement, since it would allow Russia to punish Ukraine by withholding shipments of natural gas without punishing countries such as Germany further downstream.

Of course, Germany may try to diversify its energy sources, which include Libya, Nigeria, Kazakhstan, Norway, and the Netherlands, but it would struggle to do so. Germany relies heavily on pipelines for its energy, particularly Russian natural gas. It has four cross-border crude oil pipelines, four domestic pipelines, and three oil ports in the North and Baltic seas. But Germany has fewer options for natural gas and no major LNG facilities. Simply put, Germany is beholden to the countries with which its pipelines have a connection—something that makes it vulnerable to retaliation.

But there is only so much Russia can do. Its geopolitical interests in Ukraine, for example, align with Germany’s energy interests. Germany would benefit from Nord Stream 2 by getting a new natural gas route, and Russia would benefit by gaining more leverage over Ukraine. But Washington wouldn’t want Moscow to halt energy flows through Ukraine at its leisure. The US needs to try to manage the Ukraine situation in a way that prevents a greater general German-Russian alignment.

Russia, moreover, cannot bully the United States with its energy exports. Washington doesn’t need them. But Russia could influence US allies if it chose to retaliate more than it already has. Since the US is far more powerful than Russia, divide and conquer may be Moscow’s best bet.