Based on current refinery operations, it is estimated that anywhere from 1 million to 2.2 million barrels per day of refining capacity are offline, as well as just under half a million bpd of production. The U.S. has been producing around 9.5 million barrels per day, and in general, U.S. production has beaten 2016 Energy Information Administration estimates for 2017 production. This production has played a major role in keeping global oil prices low, in turn hurting oil-dependent countries like Russia and Saudi Arabia.

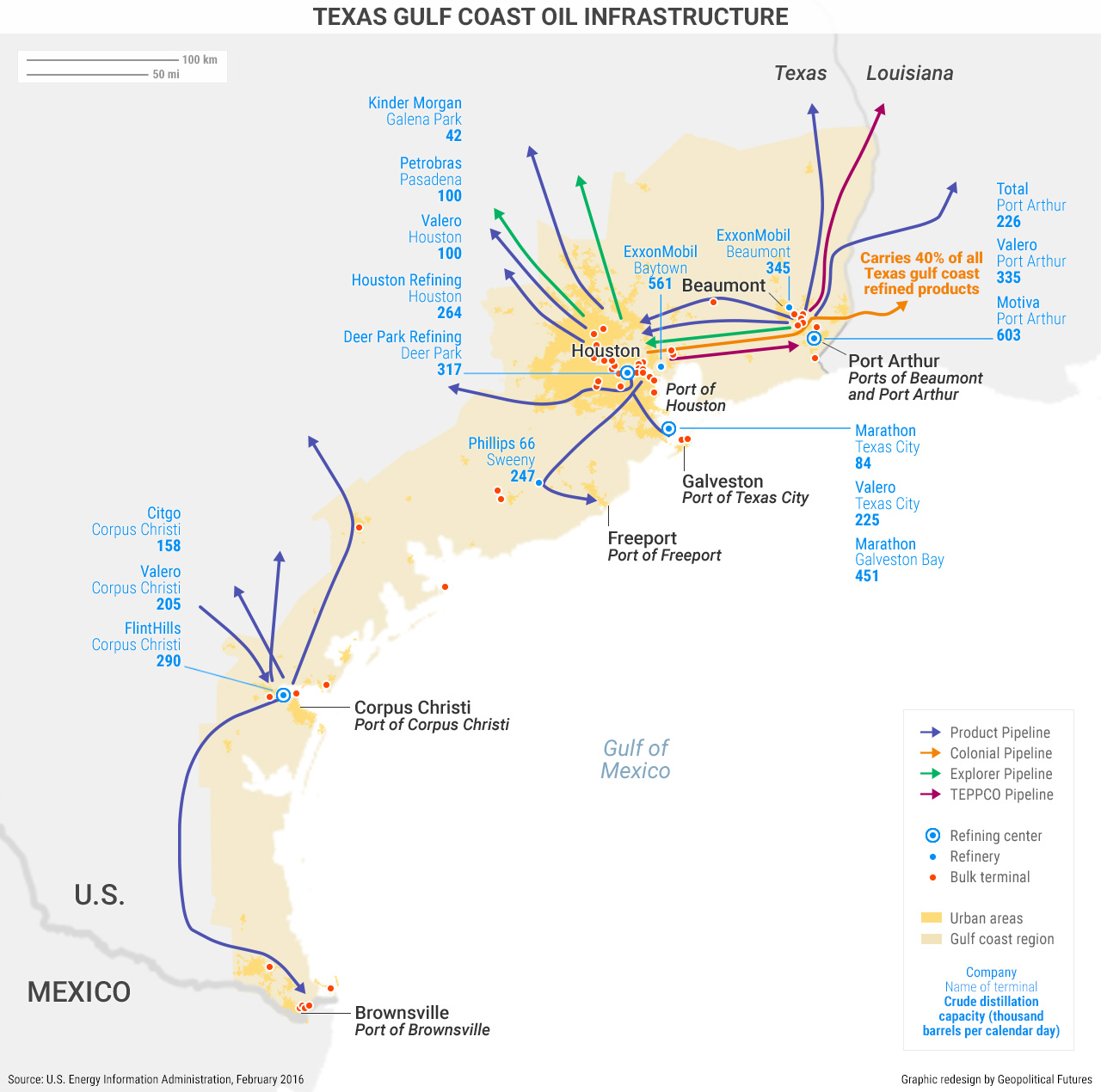

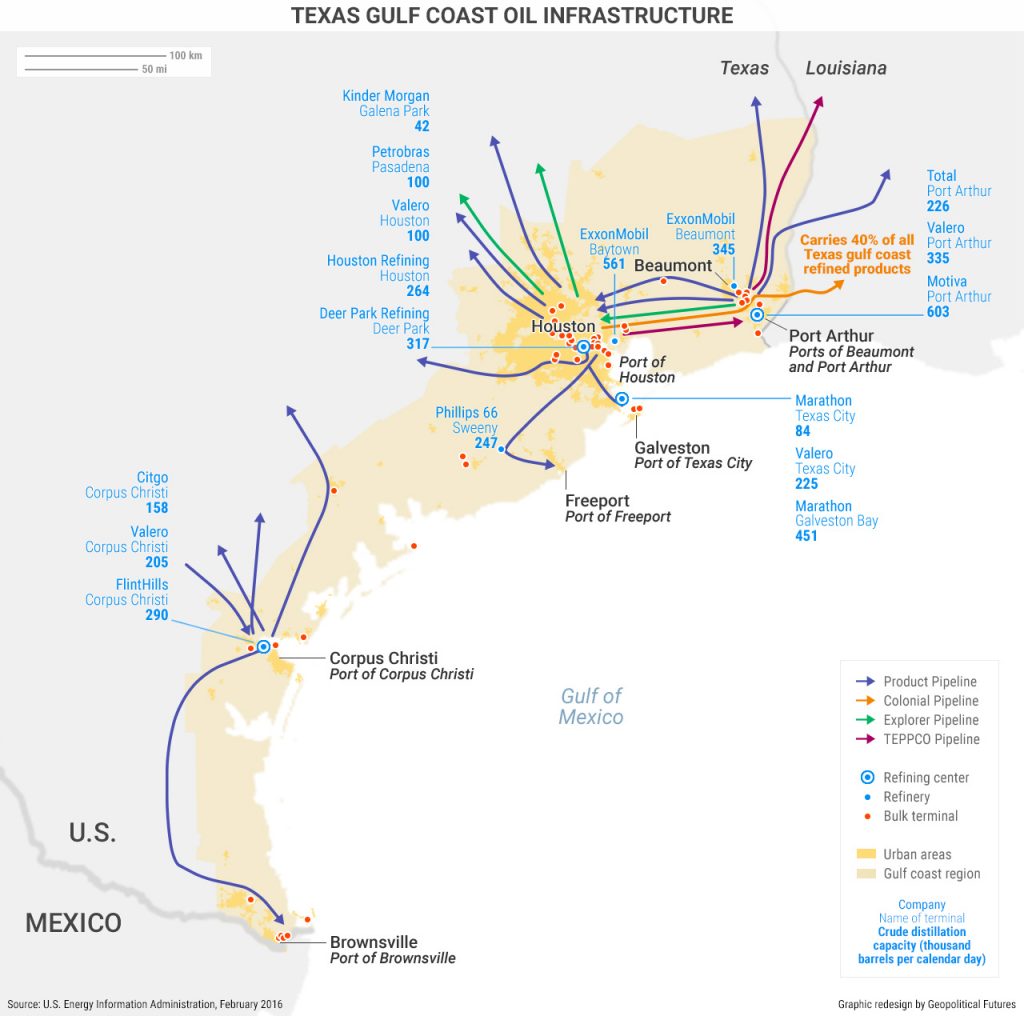

Harvey’s impact on U.S. oil production will be temporary, even if it is severe. In the short term, though, it could be globally significant. Harvey has passed, but new storms in the Gulf of Mexico and Atlantic Ocean are threatening to dump more rain on the Gulf Coast. If there is damage to the Colonial Pipeline – which transports more than 40 percent of the Texas Gulf Coast’s refined product, according to the EIA – U.S. consumers would not only have to pay more at the pump, but U.S. policymakers would have to deal with Russia, which would greatly benefit from even a momentary spike in prices. It won’t be clear what will happen to oil prices until we know what kind of damage coastal facilities have sustained, but the possibility of higher prices can’t be ruled out.