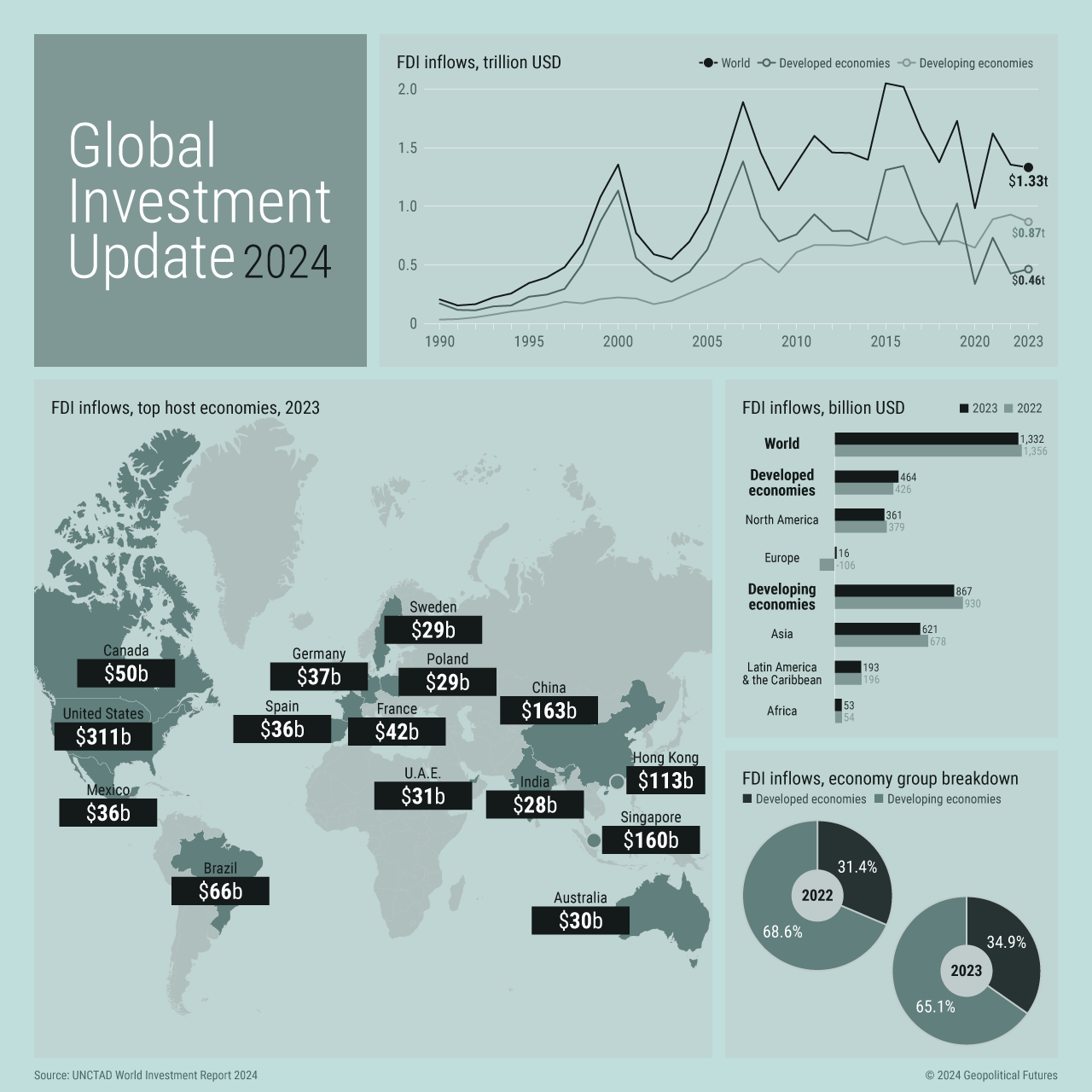

The 2023 data for greenfield foreign direct investment presents a mixed picture but overall one of resilience. According to the U.N. Conference of Trade and Development’s Global Investment Report, FDI flows fell by 2 percent to $1.3 trillion, and developing nations saw a 7 percent drop to $867 billion. However, developed economies saw a 9 percent increase, driven mainly by Singapore and the European Union. The qualities that attract investors to Singapore – a business-friendly environment and strategic location – are persistent, whereas Europe made gains due to its post-pandemic recovery, reshoring, and friendshoring linked to global economic restructuring and the Ukraine conflict.

Developing countries still attract over 60 percent of global FDI, and they tend to offer foreign investors more favorable terms. UNCTAD’s report said that 86 percent of investment policy measures in developing nations were investor-friendly, compared to 57 percent in developed countries, where FDI screening processes are becoming more common for national security reasons. The report also warned that protectionism and decoupling create obstacles for FDI.