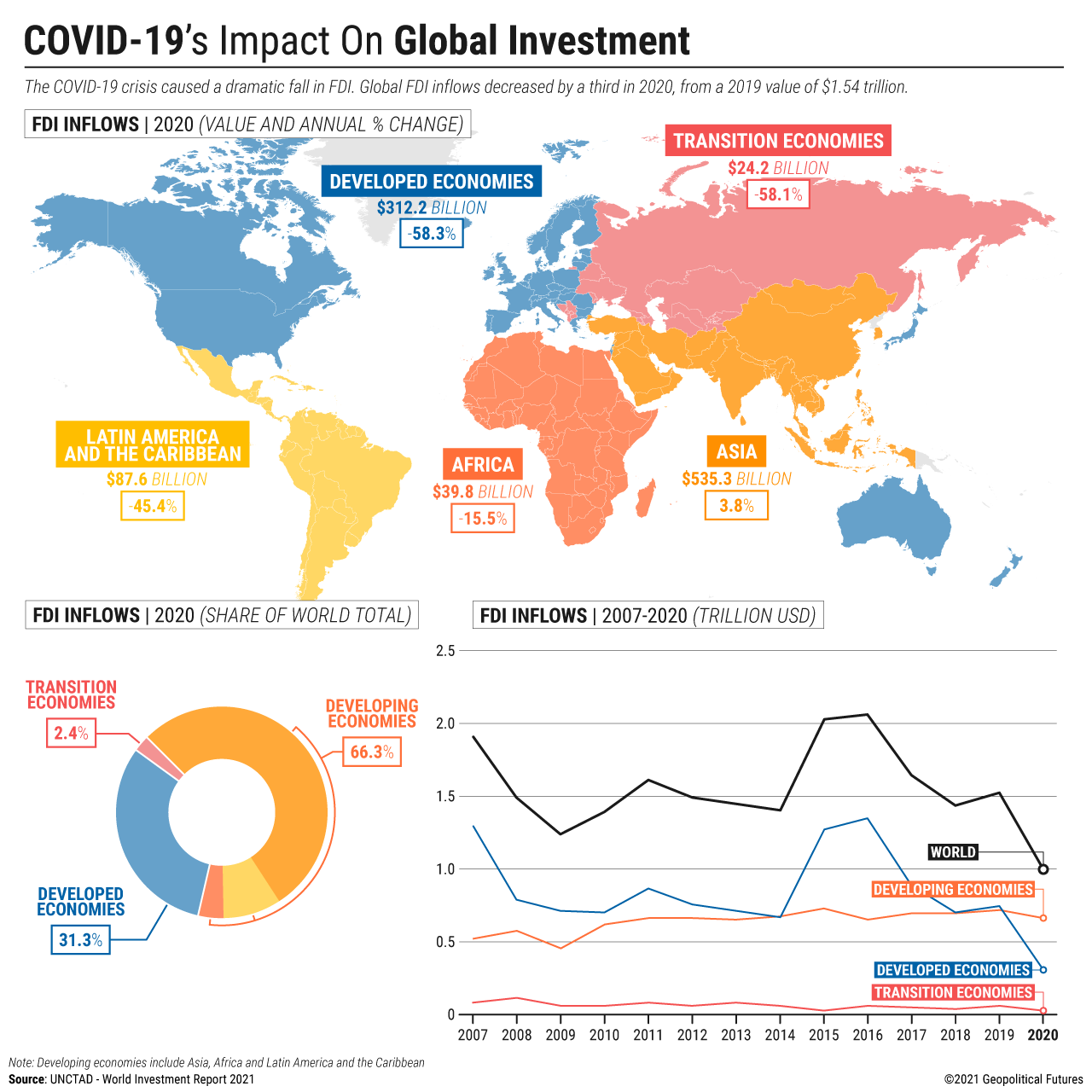

Foreign direct investment is the trademark of the globalization of the international economy. FDI flows suffered greatly in 2020 because of pandemic-related business closures, supply chain disruptions and the economic downturn. Global FDI fell by 35 percent to a total of $1 trillion, with developed economies hit particularly hard. FDI flows to Europe fell by 80 percent, while flows to North America fell by 42 percent.

FDI is essential for developing countries, as it provides a significant source of funding that fuels local industries and infrastructure projects. Among developing economies, Latin America stands out for having significantly larger decreases in FDI inflows compared to its Asian and African counterparts. Many Latin American economies rely on investment in natural resources and tourism, both of which collapsed during the pandemic. This year, greater competition is expected for FDI. The World Investment Report from the United Nations anticipates growth of 10-15 percent in FDI this year, which is still about a quarter less than global FDI in 2019. A return to pre-pandemic levels is not expected until 2022 at the earliest.