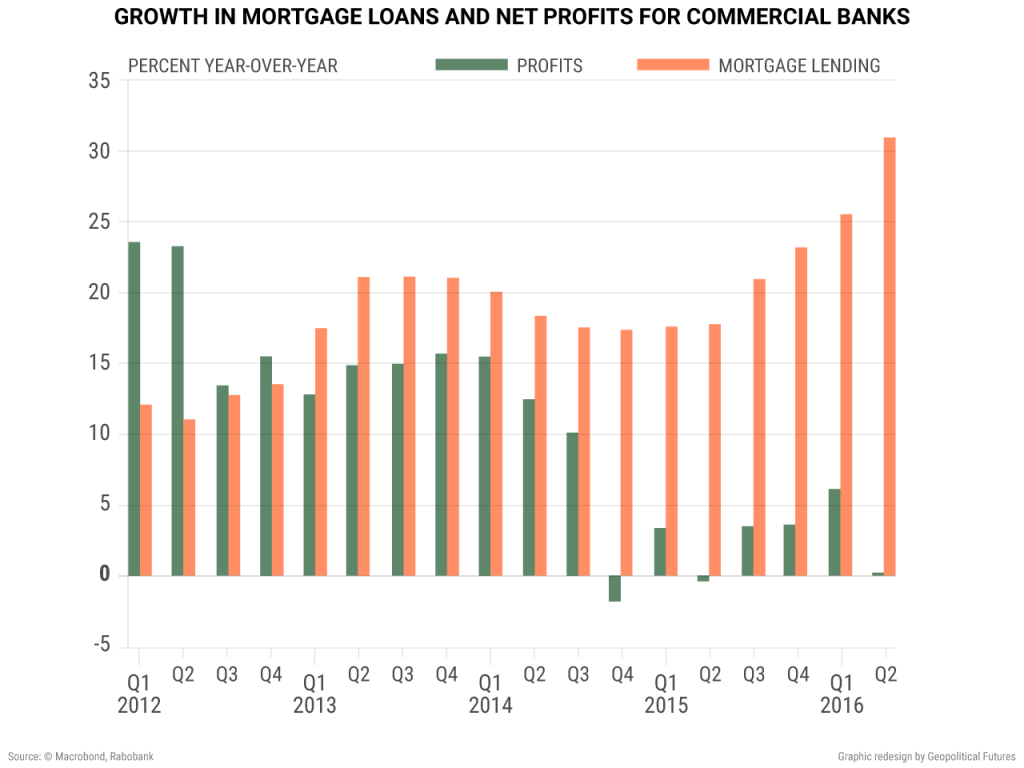

As banks extended additional credit to real estate developers and buyers, their profitability stagnated. In theory, China’s economy is not technically based on capitalism and therefore doesn’t revolve around profitability; in practice, however, money needs to come from somewhere. A company that doesn’t generate profit can’t sustain itself in the long run. The Chinese government can’t afford to let banks fail since doing so would threaten both the financial system’s health and the critical lifeline to state-owned enterprises that provide jobs.

This surge in China’s real estate prices, fueled by ongoing credit expansion, are forcing the government to choose between deflating the housing market and slowing growth. To learn more about why all available options will present consequences that will further strain some aspect of the Chinese economy and, therefore, the stability of the country’s political system, check out or recent Deep Dive, “Real Estate and Debt in China: One Road to Discontent.”