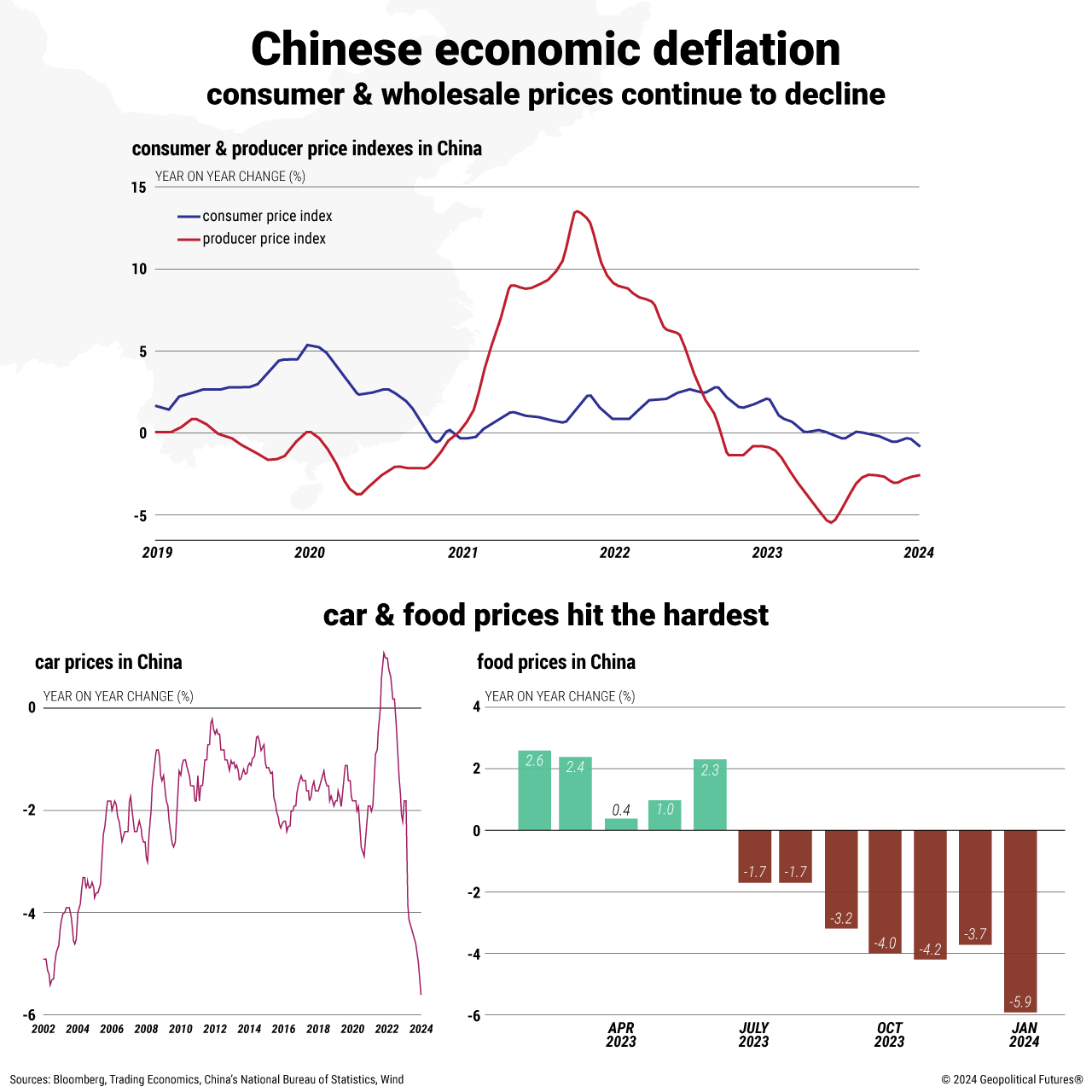

Recent data show China experiencing its sharpest decline in consumer prices in over 14 years, while producer prices fell by 2.5 percent, dropping for the 16th month in a row. This situation indicates a significant risk of prolonged deflation in China, exacerbated by challenges like a real estate slump, stock market downturn, loss of investor confidence, weaker exports and low consumer demand. Despite expectations for a temporary price rebound in February due to Lunar New Year demand, China’s economic issues – excess supply, insufficient demand and financial strain – persist.

China’s deflation is impacting the global economy, potentially accelerating interest rate cuts in emerging markets reliant on Chinese goods and raising concerns in the West about competitive disadvantages due to cheaper Chinese exports. This scenario suggests a global influx of low-priced imports as China seeks international buyers, which, while tempering inflation in some regions, poses broader economic challenges.