China has become a major rescue lender for heavily indebted countries. In 2022, loans to countries in debt distress accounted for 60 percent of China’s overseas lending portfolio – up sharply from just 5 percent in 2010.

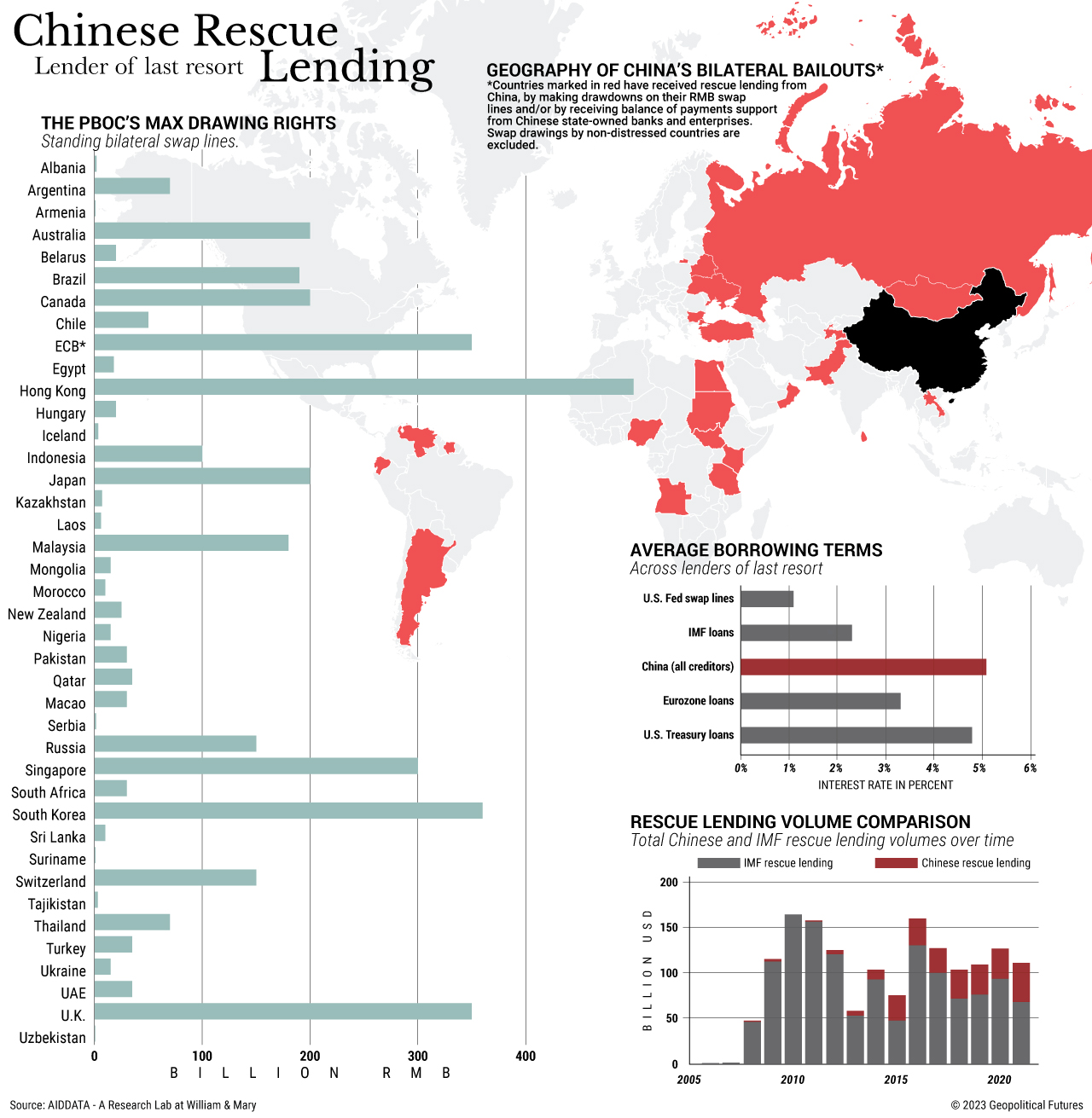

Over the past two decades, Chinese institutions have provided $240 billion in rescue lending to 22 developing countries. Of that sum, $170 billion was provided through the People’s Bank of China’s swap line network – a system whereby central banks agree to exchange currencies. The rest was offered through other means such as bridge loans or balance of payments support by Chinese state-owned banks and enterprises, including the China Development Bank. They’re provided, generally with high interest rates, mostly to middle-income countries, which account for four-fifths of China’s overall lending. Low-income countries are given grace periods and maturity extensions.

However, these loans, often doled out as part of China’s Belt and Road Initiative, have been highly criticized for creating “debt traps” for cash-strapped borrowers. Countries like Sri Lanka, Zambia and Ghana are currently in talks with Beijing to restructure their debt. But as more governments struggle to make payments amid a global downturn, there’s growing concern about China’s ability to refinance the loans and avoid financial problems at home if debtors can’t repay them.

2025 Forecast: The World Without an Anchor

2025 Forecast: The World Without an Anchor