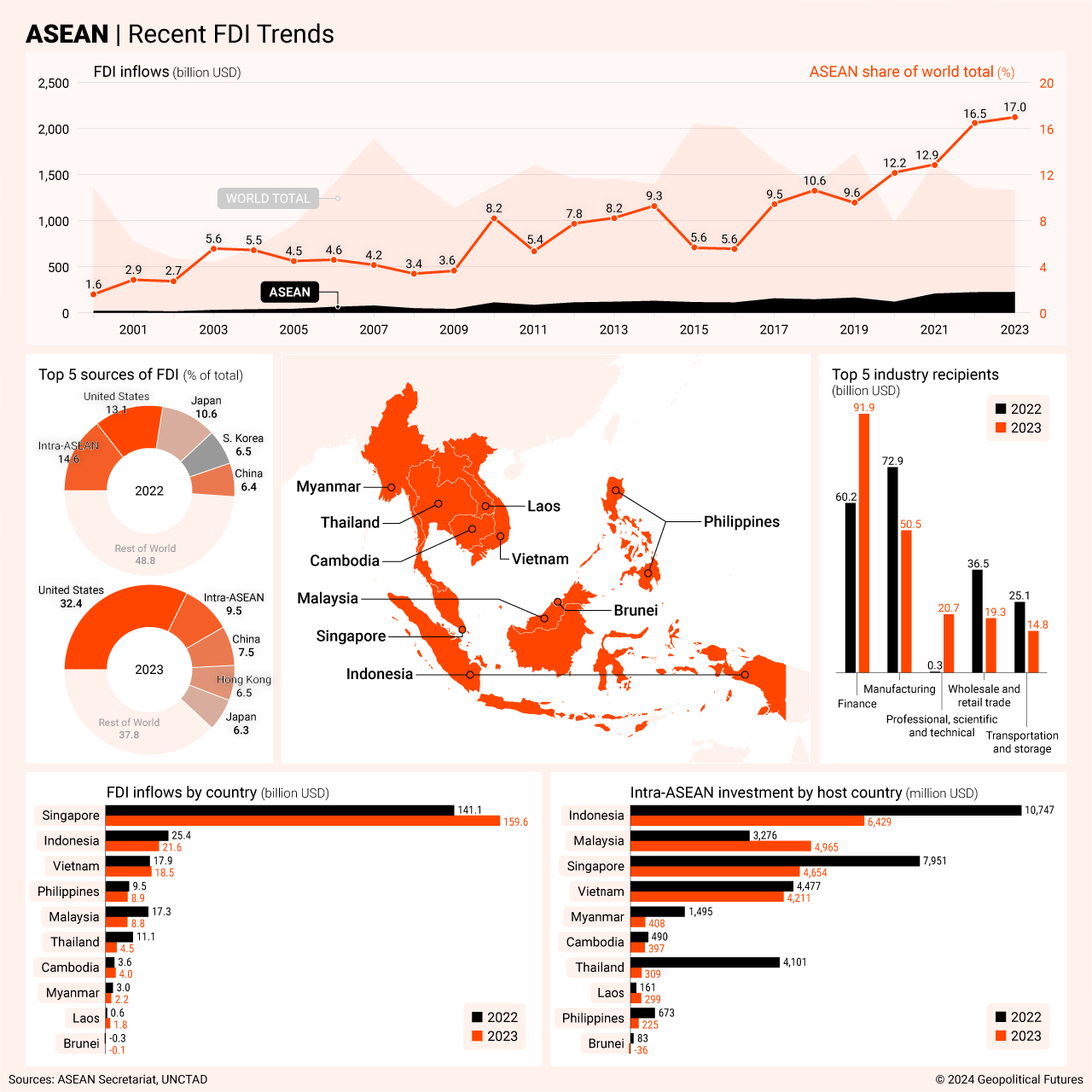

Amid global uncertainties, companies diversifying supply chains away from China have driven a surge in foreign direct investment into the countries that make up the Association of Southeast Asian Nations (ASEAN). In 2023, FDI inflows to the region reached $236 billion, up sharply from the annual average of $190 billion from 2020 to 2022. ASEAN’s share of global FDI rose to 17 percent in 2023, compared to an average of just 6 percent from 2006 to 2015.

Investment came primarily from the United States, Japan, China, Hong Kong, Europe and South Korea, spurred by geopolitical tensions and the bloc’s pro-investment policies. ASEAN has leveraged regional agreements and frameworks to attract capital, targeting sectors such as infrastructure, digital economy, finance, transportation and renewable energy. Investors are attracted to ASEAN’s stability, competitive advantages and diverse opportunities. Singapore remains a hub for hardware, software and services, while Vietnam and Indonesia lead in manufacturing sectors, including electronics, chemicals, solar panels and shipping containers. To sustain this momentum, ASEAN could focus on expanding small businesses, fostering emerging industries, enhancing skills development and deepening regional integration through additional trade and investment deals.