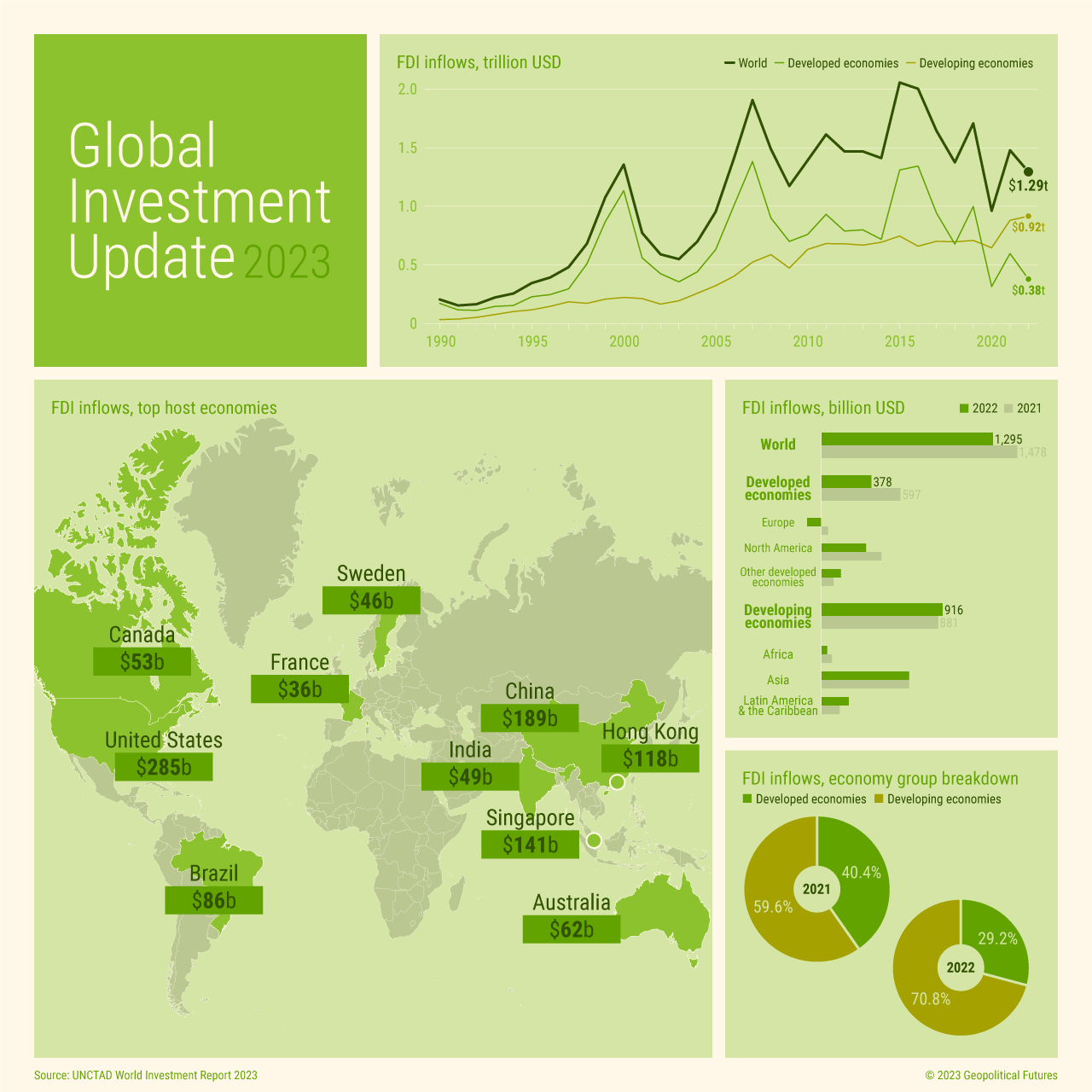

2021 saw spikes in foreign direct investment in many regions around the world as economies began their recoveries from the COVID-19 pandemic, which instigated a global collapse in FDI. 2022, however, couldn’t sustain the upswing as the war in Ukraine, the effects of sanctions, rising food and energy prices, and logistical problems discouraged risk-averse investors from spending their cash. And it seems that many economies will face similar challenges in 2023.

Not every region felt the global downturn, however. Developing economies saw a slight overall increase in FDI, driven by substantial growth in Latin America and the Caribbean. Unsurprisingly, this is a region that hasn’t been markedly affected by the geopolitical risk factors, like sanctions and conflict, that suppressed investor confidence elsewhere. Asia, too, was not as affected by these factors as Europe – and saw little change in FDI inflows between 2021 and 2022. Indeed, developed economies, led by Europe, drove the global dip in investment.