As the coronavirus has spread across the globe, it has paralyzed economies. With widespread quarantines, demand has lagged, supply chains have been disrupted, businesses have closed and workers have been laid off, paving the way for a serious recession. The International Monetary Fund has forecast that the coronavirus pandemic will prompt the worst financial crisis since the Great Depression.

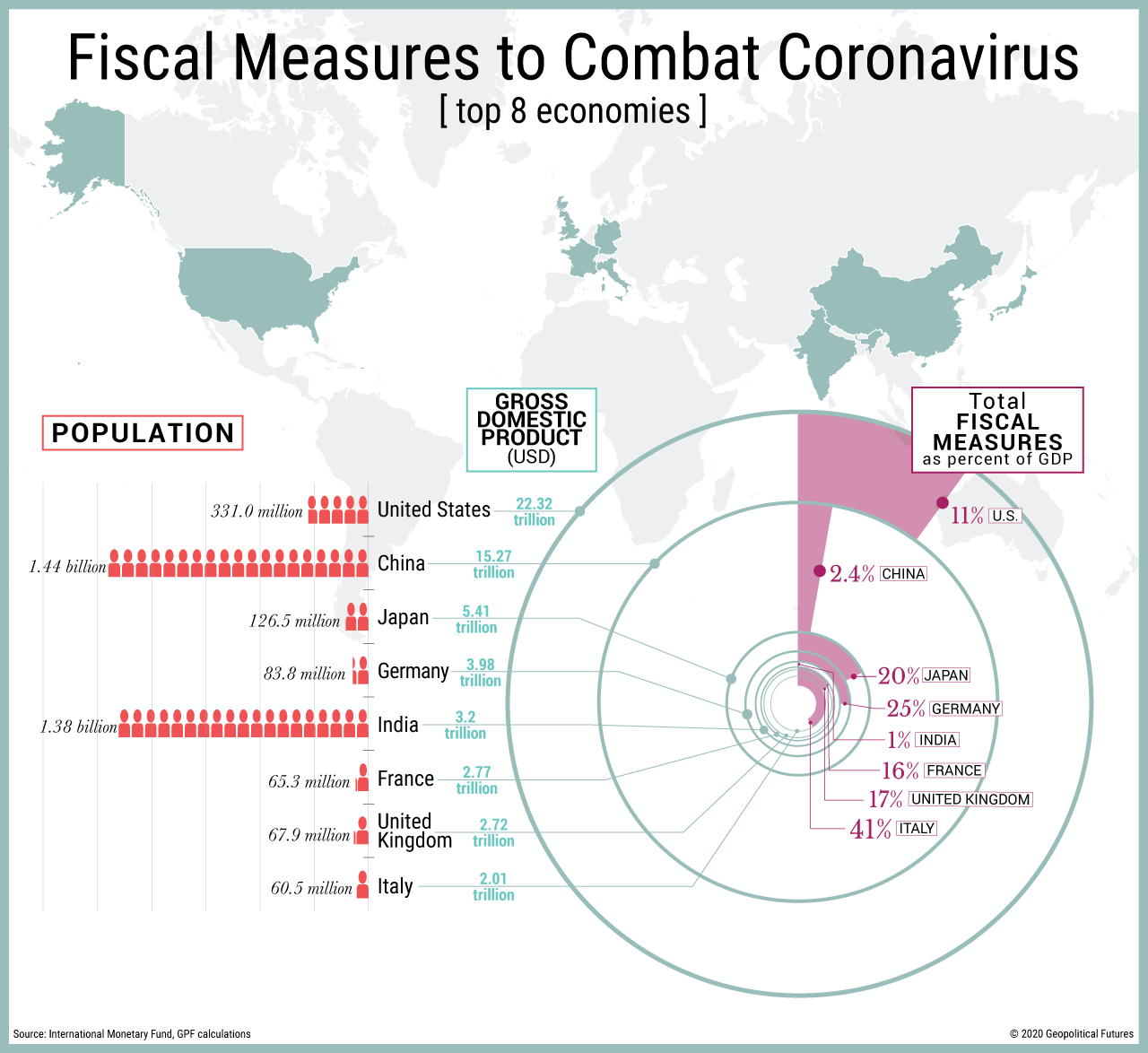

To limit this economic shock, national governments have rushed to inject cash into their economies. The above countries account for close to two-thirds of the global economy. These measures aim to prop up companies, preserve jobs and provide income to consumers who are currently out of work or not getting a paycheck. How much is enough to mitigate the shock will depend in part on an economy’s health going into the crisis and how long economies remain in quarantine.

One recommendation circulating among economists is for governments to commit emergency response packages that constitute at least 5 percent of their gross domestic product. While some of the world’s largest economies have far surpassed the 5 percent recommendation, others have been cautious about increasing public spending, or have indicated a second round of stimulus is on the way. China, despite being heavily afflicted by the virus, has implemented a stimulus package but has placed a heavy focus on infrastructure and investment in state-owned companies to alleviate market pressure.

The truth is that these countries find themselves in uncharted territory, and no one knows what amount is enough. What we do know is that these moves are the first step toward dealing with the global recession. These first-round stimulus measures will ideally help economies avoid complete collapse while waiting for economic activity to resume more regularly. At that point, more measures for recovery will likely be needed.