Each budget, both the consolidated and federal, is constituted by tax revenues such as VAT, excises for gasoline, cars, fuel and tax mineral extraction, and non-tax revenues such as fees and payments. Export custom duties go to the federal budget. Personal income taxes, property taxes, resort fees and land taxes are directed to the consolidated budget. Some taxes – for example, corporate income tax – are divided and flow into both budgets. However, all taxes and revenues associated with oil and gas activities are fed into the federal budget and so are also included on the consolidated budget.

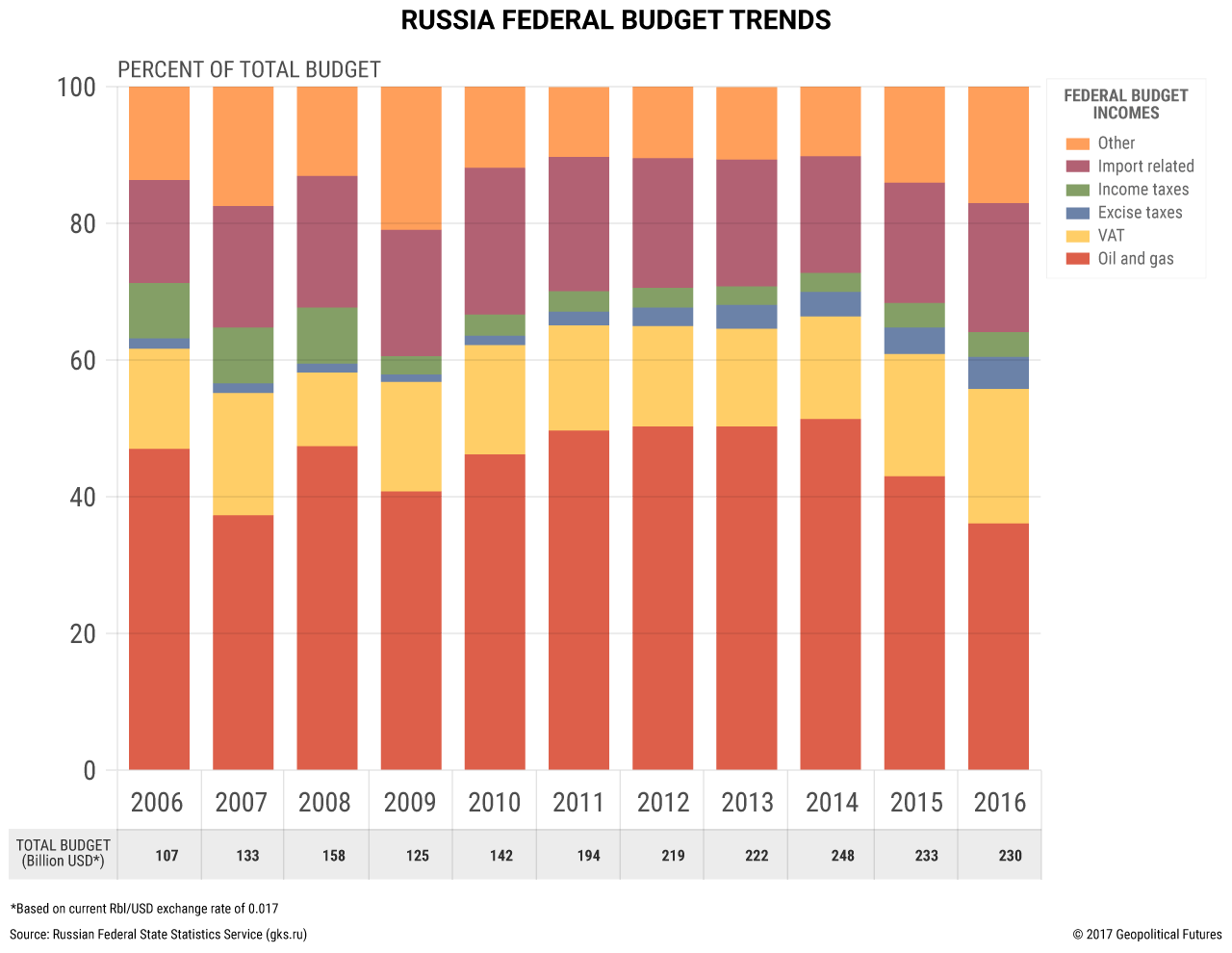

Two trends are apparent in the federal budget – the one controlled only by Moscow. The first is a decline in tax revenue from oil and gas activities. It fell from 51.3 percent of the budget in 2014 to 36 percent in 2016. The second is a steady increase in non-oil and gas incomes as a percentage of the total budget through the same period. In absolute terms, oil and gas income also fell from 2014 to 2016, and non-oil and gas income has increased steadily since 2009.

Since all oil and gas income that flows to the consolidated budget is already captured by the federal budget, income trends in the consolidated budget mirror those in the federal budget. Oil and gas income as a percentage of the total budget declined from 27.8 percent of the consolidated budget in 2014 to 17.2 percent in 2016, and non-oil and gas incomes have increased as a percentage of the budget and in absolute terms.

Given the decline in global oil and gas prices, decreased oil and gas revenue was expected. What is surprising is the continued increase, in absolute terms, of non-oil and gas incomes. Had Russia, in the past few years, developed an industrial base capable of offsetting its losses from oil and gas?

Different industries’ contributions to the gross domestic product reveal that that is not exactly the case. Though manufacturing has grown in absolute terms over the past decade or so, its contribution to GDP has grown only slightly. In real terms, this suggests that the increase in non-oil and gas incomes is due instead to a more efficient tax collection system. In fact, over the past few years, the Kremlin has implemented a number of tax reforms to do just that.

The Geopolitics of the American President

The Geopolitics of the American President